1. Introduction: The Dual Giants of Cryptocurrency

The cryptocurrency market is vast and rapidly evolving, but Bitcoin (BTC) and Ethereum (ETH) remain the undisputed giants of the space. Despite the proliferation of thousands of cryptocurrencies and blockchain projects, Bitcoin and Ethereum hold the largest market share and continue to lead the way in terms of both adoption and technological development.

- Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first successful decentralized digital currency. It operates on a proof-of-work (PoW) consensus mechanism and has established itself as a store of value, often referred to as “digital gold.”

- Ethereum, launched in 2015 by Vitalik Buterin and his team, took the concept of blockchain a step further by enabling the development of smart contracts and decentralized applications (dApps). Ethereum’s flexibility allows it to support a range of use cases, from decentralized finance (DeFi) to non-fungible tokens (NFTs), making it the second-largest cryptocurrency by market capitalization.

While Bitcoin has established itself as a store of value and a means of peer-to-peer digital payment, Ethereum’s ability to create decentralized applications and its smart contract functionality has made it the foundation of an entirely new ecosystem, ranging from decentralized finance (DeFi) to supply chain management and beyond.

2. Bitcoin: The Pioneer of Decentralized Digital Money

2.1 Bitcoin’s Revolutionary Impact on the Financial System

Bitcoin’s primary innovation is its ability to function as a peer-to-peer digital currency without the need for a trusted third party, such as a bank or financial institution. By leveraging blockchain technology, Bitcoin allows users to send and receive payments directly to one another in a secure and transparent manner. The key features that have made Bitcoin so revolutionary include:

- Decentralization: Bitcoin operates on a distributed network of nodes, meaning no single entity controls the network. This decentralization ensures that Bitcoin remains resistant to censorship and government interference.

- Security and Immutability: Bitcoin transactions are secured through the process of mining, which involves solving complex mathematical problems to validate transactions. This makes the network highly secure and resistant to fraud. Once a transaction is added to the Bitcoin blockchain, it becomes immutable, meaning it cannot be altered or reversed.

- Scarcity and Digital Gold: Bitcoin’s total supply is capped at 21 million coins, a feature that creates scarcity and drives its value over time. This limited supply, combined with its decentralized nature, has led many to refer to Bitcoin as “digital gold,” as it serves as both a store of value and a hedge against inflation.

2.2 Bitcoin’s Role in the Digital Economy

Bitcoin’s adoption has extended far beyond individual users to encompass a range of industries and institutional investors. Large corporations like Tesla and MicroStrategy have made significant investments in Bitcoin as a treasury asset, while PayPal, Square, and other fintech companies have integrated Bitcoin into their platforms, allowing users to buy, sell, and spend BTC. This increasing institutional adoption signals a broader acceptance of Bitcoin as a legitimate financial asset and has contributed to its rise in market value.

Furthermore, Bitcoin has sparked a growing interest in central bank digital currencies (CBDCs), as governments worldwide seek to create their own digital currencies based on blockchain technology. The global Bitcoin ETF (Exchange Traded Fund) market is another example of how Bitcoin is becoming more integrated into traditional financial markets.

3. Ethereum: The Blockchain for Decentralized Applications

3.1 Ethereum’s Innovation: Smart Contracts and dApps

Ethereum’s groundbreaking innovation lies in its ability to support smart contracts, which are self-executing agreements written in code. Smart contracts automatically execute transactions when certain predefined conditions are met, eliminating the need for intermediaries. This ability to execute programmatic transactions has opened the door to a wide variety of decentralized applications (dApps) that span industries such as finance, gaming, supply chain, and real estate.

Ethereum’s unique features include:

- Smart Contracts: Ethereum’s ability to run smart contracts is its primary innovation. These contracts are executed by the Ethereum Virtual Machine (EVM), a decentralized runtime environment that ensures that the terms of the contract are executed automatically when the conditions are met.

- Tokenization and ERC-20: Ethereum enabled the creation of ERC-20 tokens, a standardized token format that allows developers to create their own tokens on top of the Ethereum blockchain. This has given rise to countless projects in the DeFi ecosystem, allowing for the creation of new tokens, decentralized exchanges (DEXs), and lending platforms.

- Decentralized Finance (DeFi): Ethereum has become the foundation for the rapidly growing DeFi ecosystem. DeFi platforms leverage Ethereum’s smart contracts to create decentralized lending, borrowing, staking, and yield farming solutions. These platforms allow individuals to access financial services without the need for traditional banks or intermediaries.

3.2 Ethereum’s Evolution: From Proof of Work to Proof of Stake

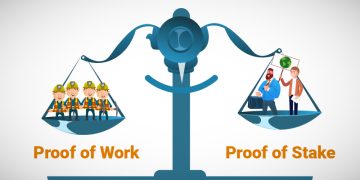

Ethereum has undergone significant technological changes to improve scalability, reduce energy consumption, and increase the overall efficiency of the network. One of the most notable changes is the transition from the proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS) with the implementation of Ethereum 2.0.

- Ethereum 2.0 (Eth2): Ethereum’s transition to Ethereum 2.0 is an ongoing process aimed at enhancing the scalability and security of the network. The move to PoS reduces Ethereum’s energy consumption and allows for faster transaction finality. Additionally, PoS enables staking, where users can earn rewards by participating in the network’s consensus process.

- Layer 2 Solutions: To address scalability concerns, Ethereum has also seen the rise of Layer 2 solutions like Optimistic Rollups and zk-Rollups, which enable faster transactions and reduced fees without compromising security. These Layer 2 solutions are essential for Ethereum to handle the growing demand for decentralized applications and transactions.

4. The Synergy Between Bitcoin and Ethereum: Complementary Forces in the Crypto Space

While Bitcoin and Ethereum serve different primary functions, they complement each other in the broader cryptocurrency ecosystem. Bitcoin’s role as a store of value and a digital gold alternative contrasts with Ethereum’s emphasis on decentralized applications and smart contract functionality. Despite their differences, the two networks often work in tandem, with many DeFi projects using BTC as collateral or integrating Bitcoin into their platforms.

Ethereum has benefited from Bitcoin’s established brand recognition and network effect. Conversely, Bitcoin has leveraged Ethereum’s advancements in blockchain technology to explore new use cases, such as tokenized Bitcoin (e.g., Wrapped Bitcoin (WBTC)) for use on Ethereum-based platforms.

5. Challenges and Opportunities Ahead for Bitcoin and Ethereum

5.1 Scalability and Transaction Speed

Both Bitcoin and Ethereum face significant challenges related to scalability. As the adoption of cryptocurrencies grows, both networks have experienced congestion, leading to higher transaction fees and slower processing times.

- Bitcoin Scaling Solutions: Bitcoin is exploring solutions like the Lightning Network, a second-layer protocol that enables faster and cheaper transactions by creating off-chain payment channels.

- Ethereum Scaling Solutions: Ethereum’s ongoing transition to Ethereum 2.0 and the implementation of Layer 2 solutions aim to address these scalability challenges. However, the success of these solutions remains to be seen.

5.2 Regulatory Challenges and Global Adoption

Both Bitcoin and Ethereum face regulatory hurdles in different parts of the world. While Bitcoin has gained acceptance as a store of value, its regulatory treatment as a commodity or currency varies by jurisdiction. Ethereum’s role as a platform for DeFi and tokenized assets adds an additional layer of complexity when it comes to regulation.

Despite these challenges, the increasing institutional adoption of both Bitcoin and Ethereum points to a future where digital assets are more deeply integrated into the global financial system.

6. Conclusion: The Future of Bitcoin and Ethereum

Bitcoin and Ethereum have undeniably shaped the landscape of the cryptocurrency market. Bitcoin continues to be the gold standard for decentralized, censorship-resistant digital money, while Ethereum has become the bedrock for innovation in decentralized applications and smart contracts.

As the cryptocurrency ecosystem continues to evolve, both networks will continue to drive technological innovation and play crucial roles in the broader digital economy. Their journey is far from over, and their future will be defined by their ability to scale, adapt to new technologies, and navigate regulatory challenges. One thing is clear: Bitcoin and Ethereum are poised to remain at the forefront of the digital revolution for years to come.