Introduction

The art market has historically been a highly centralized ecosystem, dominated by galleries, auction houses, wealthy collectors, and established artists. This concentration of power has often restricted access, limited transparency, and constrained the participation of emerging artists and smaller collectors. However, the rise of blockchain technology and non-fungible tokens (NFTs) has catalyzed a paradigm shift, ushering in the era of a decentralized art market.

Decentralization in this context refers to a system where ownership, transactions, and value creation are no longer controlled by a few intermediaries. Instead, blockchain-enabled platforms allow direct interactions between creators and collectors, enforce transparency through immutable records, and democratize access to both physical and digital art assets.

This article explores the decentralization of the art market, analyzing its mechanisms, advantages, challenges, and broader implications. We will examine how NFTs, blockchain platforms, and tokenization are reshaping ownership models, market dynamics, and artist-collector relationships, while also considering regulatory, technological, and cultural impacts.

Chapter 1: The Centralized Art Market – Structure and Limitations

1.1. Traditional Market Dynamics

Historically, the art market has been structured around a few dominant players:

- Galleries: Serving as intermediaries, they manage exhibitions, sales, and artist promotion, often taking 30–50% of sales revenue.

- Auction Houses: Institutions like Sotheby’s and Christie’s influence pricing and trends, acting as gatekeepers for high-value artworks.

- Collectors: Wealthy individuals or entities hold significant market power, determining demand and liquidity.

This concentration creates barriers to entry for emerging artists and new investors, limiting diversity and often leaving smaller participants at a disadvantage.

1.2. Challenges Faced by Artists and Collectors

- Limited Market Access: Emerging artists struggle to gain visibility without gallery representation or institutional endorsement.

- Lack of Control: Artists lose control over secondary sales, pricing, and future market potential.

- High Transaction Costs: Commissions, fees, and intermediaries reduce net earnings for creators.

- Opacity: Provenance and authenticity verification often require trust in intermediaries, leaving room for fraud or misinformation.

These structural inefficiencies have fueled the demand for a more transparent, accessible, and equitable system, laying the groundwork for decentralized solutions.

Chapter 2: Blockchain Technology as a Catalyst for Decentralization

2.1. Fundamentals of Blockchain

Blockchain is a distributed ledger technology where all transactions are recorded across a network of computers (nodes) in an immutable and verifiable manner. Key features include:

- Transparency: All participants can view and verify transactions.

- Immutability: Once recorded, data cannot be altered, ensuring provenance and trust.

- Smart Contracts: Automated agreements that execute transactions or enforce conditions without intermediaries.

These features provide a foundation for creating decentralized art marketplaces, enabling direct interaction between creators and collectors.

2.2. Implications for the Art Market

- Provenance Verification: Each artwork’s ownership history is permanently recorded on-chain, reducing fraud and disputes.

- Direct Market Access: Artists can sell works directly to collectors without galleries or auction houses.

- Automated Royalties: Smart contracts allow artists to receive royalties on secondary sales, ensuring long-term participation in the artwork’s value appreciation.

- Global Participation: Blockchain eliminates geographic restrictions, enabling global access to artists and collectors alike.

2.3. Tokenization of Art

Tokenization involves representing ownership of physical or digital artworks as digital tokens on the blockchain. Benefits include:

- Fractional Ownership: High-value artworks can be divided into shares, making them accessible to a broader audience.

- Liquidity: Tokenized artworks can be traded on digital marketplaces, enhancing market fluidity.

- Programmable Rights: Artists can encode conditions such as usage rights, exhibition permissions, and royalty structures into the token.

Chapter 3: NFTs and the Digital Art Revolution

3.1. What Are NFTs?

Non-fungible tokens (NFTs) are unique digital assets stored on a blockchain, representing ownership of a specific item—such as a digital painting, animation, or collectible. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and interchangeable, NFTs are distinct and verifiable, enabling proof of ownership and authenticity.

3.2. NFTs as a Vehicle for Decentralization

NFTs empower artists and collectors by:

- Establishing Clear Ownership: Every NFT contains metadata that proves authenticity and records previous ownership.

- Eliminating Middlemen: Artists can sell directly to collectors, retaining a larger share of revenue.

- Enabling Global Reach: NFTs can be purchased by anyone with internet access, democratizing the art market.

- Supporting Smart Contracts: Artists can program automated royalties and license conditions for secondary sales.

3.3. NFT Marketplaces

Platforms such as OpenSea, SuperRare, Foundation, and Rarible facilitate NFT sales and auctions. These marketplaces have key features:

- Digital Galleries: Virtual exhibition spaces allow collectors to view and interact with artworks.

- Auction Systems: Artists can conduct timed or open-ended auctions, potentially driving higher prices.

- Social and Community Features: NFT platforms often integrate social tools to promote collaboration, curation, and community engagement.

Chapter 4: Economic and Cultural Impacts of Decentralization

4.1. Empowering Artists

Decentralized art platforms provide artists with:

- Financial Autonomy: Artists receive a larger proportion of sale proceeds and ongoing royalties.

- Creative Freedom: Artists can experiment with new media, digital formats, and interactive experiences without institutional restrictions.

- Community Building: Direct engagement with collectors and fans fosters loyalty and long-term support.

4.2. Democratizing the Collector Experience

Collectors benefit from:

- Lower Barriers to Entry: Fractional ownership and digital marketplaces make high-value art accessible to smaller investors.

- Transparent Market Information: On-chain records provide verifiable provenance and trading history.

- Global Investment Opportunities: Collectors can discover and acquire works from emerging artists worldwide.

4.3. Cultural Transformation

- New Forms of Art: Digital-native and interactive artworks challenge traditional notions of artistic creation.

- Community Governance: Decentralized Autonomous Organizations (DAOs) allow communities to collectively curate and fund art projects.

- Art as Social Currency: NFTs and tokenized assets enable art to serve as both aesthetic and financial instruments, reshaping cultural and economic value.

Chapter 5: Challenges and Risks

5.1. Market Speculation and Volatility

The NFT and decentralized art markets are still nascent, leading to:

- Price Bubbles: Rapid speculation can inflate prices unsustainably.

- Liquidity Risks: Some digital assets may be difficult to resell, creating uncertainty for investors.

5.2. Regulatory Uncertainty

Legal frameworks for NFTs and digital ownership are still evolving:

- Intellectual Property: Clarifying copyright and licensing rights remains complex.

- Securities Law: Fractionalized or revenue-sharing tokens may fall under securities regulations in some jurisdictions.

- Taxation: Governments are still developing standards for taxing digital art and NFT transactions.

5.3. Environmental Concerns

NFTs minted on proof-of-work blockchains have significant energy consumption. Adoption of proof-of-stake mechanisms and energy-efficient blockchains is essential for sustainable growth.

5.4. Technical Risks

- Security Threats: Hacks, wallet thefts, and phishing attacks pose risks for artists and collectors.

- Platform Dependence: NFT marketplaces are centralized in operation, and failures or shutdowns could impact asset access.

Chapter 6: Future Outlook and Opportunities

6.1. Enhanced Interoperability

As blockchain standards mature, NFTs and tokenized art may become cross-platform and cross-chain, allowing collectors and artists to trade seamlessly across ecosystems.

6.2. Integration with Virtual and Augmented Reality

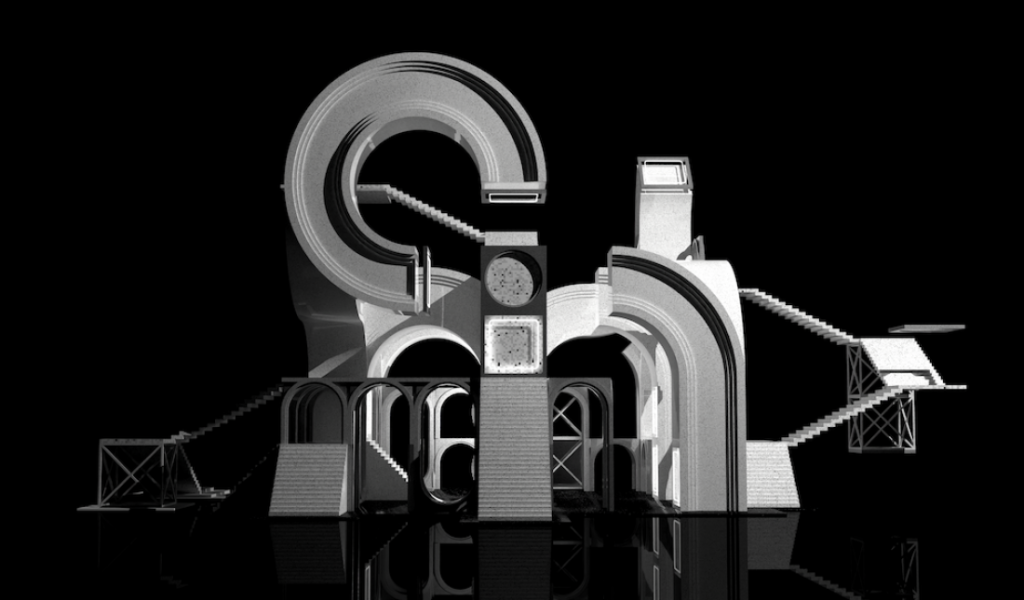

- Virtual Galleries and Metaverses: Decentralized platforms can host immersive exhibitions in 3D virtual spaces.

- AR Art Experiences: NFT art can be integrated into real-world spaces through augmented reality, enhancing engagement.

6.3. Community-Driven Art Funding

- DAOs: Decentralized Autonomous Organizations can collectively fund, curate, and govern art projects, allowing communities to shape cultural production.

- Tokenized Incentives: Communities may reward participation, curation, and promotion through token-based systems.

6.4. Sustainability and Social Impact

Decentralized art platforms have the potential to:

- Promote environmentally responsible digital art practices.

- Support charitable initiatives through NFT sales or royalties.

- Enable artists in underserved regions to participate in global markets, fostering cultural diversity.

Conclusion

The decentralization of the art market represents a fundamental transformation of how art is created, sold, and valued. By leveraging blockchain technology, NFTs, and digital marketplaces, artists gain greater autonomy, collectors access broader opportunities, and communities engage in governance and cultural production.

Despite challenges such as speculation, regulatory uncertainty, and technical risks, the potential benefits of decentralization—transparency, fairness, accessibility, and sustainability—position the art market for a new era of innovation and inclusivity.

As technology matures and adoption grows, decentralized art ecosystems are likely to coexist alongside traditional institutions, creating a hybrid model where both physical and digital art thrive. Artists, collectors, and institutions that embrace decentralization are poised to shape the future of the global art market, unlocking unprecedented opportunities for creativity, investment, and cultural engagement.