1. Introduction: Bitcoin’s Foundational Role in Cryptocurrency

In 2008, an anonymous individual or group of individuals under the pseudonym “Satoshi Nakamoto” published the Bitcoin whitepaper, a revolutionary proposal for a decentralized, peer-to-peer electronic cash system. Bitcoin was designed to solve the problem of trust in financial transactions by eliminating the need for intermediaries, such as banks, and creating a system that would be independent of central authorities.

On January 3, 2009, Bitcoin’s genesis block was mined, marking the beginning of the cryptocurrency era. Since then, Bitcoin has grown from an obscure concept into a globally recognized digital asset, with a market capitalization that often exceeds that of many large traditional companies. As of 2025, Bitcoin remains the largest cryptocurrency by market cap, despite the rise of alternative digital currencies (altcoins) such as Ethereum, Litecoin, and others.

Bitcoin’s enduring influence can be attributed to several factors, including its pioneering role in the cryptocurrency space, its decentralized nature, its finite supply of 21 million coins, and its strong network effects. Bitcoin has also played a critical role in catalyzing the development of blockchain technology, which is now used across a wide range of industries from finance to supply chain management.

2. The Technology Behind Bitcoin: A Revolutionary Blockchain

At the heart of Bitcoin’s operation lies the blockchain, a distributed ledger technology that ensures security, transparency, and immutability. Bitcoin’s blockchain is a decentralized network of nodes (computers) that collaborate to validate and record transactions, ensuring that no single party has control over the network.

2.1 The Proof-of-Work (PoW) Consensus Mechanism

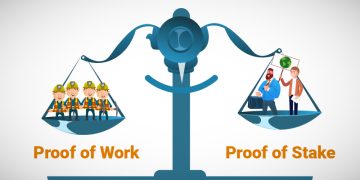

Bitcoin’s security and decentralization are ensured through the use of the Proof-of-Work (PoW) consensus mechanism. In this system, miners compete to solve complex mathematical puzzles, with the first miner to solve the puzzle adding a new block to the blockchain. This process is called “mining” and requires substantial computational power. The process is resource-intensive, but it ensures the integrity of the Bitcoin network by making it prohibitively expensive for malicious actors to alter the blockchain.

The mining process also introduces new Bitcoins into circulation, with a fixed block reward that halves approximately every four years in an event known as the “halving.” This controlled supply mechanism is designed to mirror the scarcity of precious metals like gold, with a maximum supply of 21 million Bitcoins.

2.2 Decentralization and Security

Bitcoin’s decentralized architecture ensures that no single entity can control the network. Transactions are verified by a global network of miners and nodes, and the consensus mechanism guarantees that the blockchain remains immutable. Once a transaction is added to the blockchain, it is nearly impossible to reverse or tamper with, providing a high level of security and trust.

The decentralized nature of Bitcoin also makes it resistant to censorship, as no central authority can block or alter transactions. This is particularly important in regions where individuals face financial restrictions or where governments impose capital controls. Bitcoin allows for peer-to-peer transactions without the need for an intermediary, giving individuals greater financial freedom and control over their assets.

2.3 Bitcoin’s Monetary Policy

One of Bitcoin’s most unique features is its fixed supply. Unlike fiat currencies, which can be printed at will by central banks, Bitcoin has a maximum supply of 21 million coins. This scarcity has led many to view Bitcoin as a “store of value” akin to gold, especially during times of economic uncertainty and inflation. As more people recognize the potential of Bitcoin to hedge against inflation and preserve wealth, its demand has steadily increased, contributing to its price appreciation.

The halving event, which occurs every four years, reduces the reward for mining new blocks, thus slowing the rate at which new Bitcoins are introduced into circulation. This feature is a key part of Bitcoin’s deflationary monetary policy, making it resistant to inflationary pressures that often plague fiat currencies.

3. Bitcoin’s Economic and Financial Impact

3.1 A Digital Store of Value

Bitcoin has earned the nickname “digital gold” due to its ability to act as a store of value in the digital age. Like gold, Bitcoin is perceived as a hedge against inflation, geopolitical instability, and currency devaluation. In times of economic uncertainty, investors often turn to Bitcoin as an alternative to traditional assets such as stocks, bonds, and real estate.

The global adoption of Bitcoin by institutional investors, such as Tesla, MicroStrategy, and various hedge funds, has further cemented its status as a legitimate financial asset. Bitcoin is also gaining traction among retail investors, with various exchanges and wallets making it easier for individuals to buy, sell, and store Bitcoin securely.

3.2 Bitcoin as a Medium of Exchange

While Bitcoin’s volatility has made it challenging to use as a daily medium of exchange, many businesses and platforms have begun accepting Bitcoin as payment for goods and services. From online retailers to physical stores, more merchants are embracing Bitcoin as a viable alternative to traditional payment methods.

The advent of Layer 2 solutions, such as the Lightning Network, has improved Bitcoin’s scalability, making it faster and more affordable for everyday transactions. The Lightning Network allows for off-chain transactions that settle on the Bitcoin blockchain, significantly reducing transaction fees and enabling microtransactions. This development could pave the way for Bitcoin to become more widely adopted as a payment system.

3.3 Global Financial Inclusion

Bitcoin has the potential to revolutionize financial inclusion, particularly in regions where traditional banking services are inaccessible or unreliable. Over 2 billion people around the world are unbanked, meaning they do not have access to formal financial services. Bitcoin allows individuals in these regions to participate in the global economy by providing a decentralized, digital alternative to traditional banking.

By simply using a smartphone and an internet connection, individuals can send and receive Bitcoin across borders, without the need for expensive intermediaries. This could be especially valuable in emerging markets, where remittances from abroad often come with high fees. Bitcoin offers a faster, cheaper alternative for transferring money across borders.

4. The Challenges Facing Bitcoin

Despite its success, Bitcoin faces several challenges that could hinder its widespread adoption.

4.1 Scalability Issues

Bitcoin’s current transaction throughput is limited by its block size and the time it takes to process each block. This results in slower transaction times and higher fees during periods of high demand. While solutions like the Lightning Network and other Layer 2 technologies are being developed to address scalability, Bitcoin’s base layer still faces limitations in terms of processing large numbers of transactions.

4.2 Energy Consumption and Environmental Impact

Bitcoin mining, due to its reliance on the Proof-of-Work consensus mechanism, is often criticized for its high energy consumption. As miners compete to solve complex mathematical puzzles, they require large amounts of electricity to power their mining rigs. This has led to concerns about Bitcoin’s environmental impact, particularly as global awareness of climate change increases.

To mitigate these concerns, some Bitcoin miners are exploring the use of renewable energy sources, such as solar and wind power, to reduce their carbon footprint. Additionally, the ongoing development of alternative consensus mechanisms, such as Proof-of-Stake (used by Ethereum), may eventually lead to more energy-efficient blockchain systems.

4.3 Regulatory Uncertainty

The regulatory landscape for Bitcoin and other cryptocurrencies remains unclear in many jurisdictions. Governments around the world have varied approaches to regulating digital currencies, with some countries embracing Bitcoin while others have imposed strict regulations or outright bans. The lack of a consistent regulatory framework presents challenges for both investors and businesses operating in the cryptocurrency space.

As governments continue to grapple with how to regulate Bitcoin and other cryptocurrencies, the outcome of these regulatory decisions will have a significant impact on the future growth and adoption of Bitcoin. A clear and favorable regulatory environment could encourage institutional investment and adoption, while stringent regulations could stifle innovation and hinder adoption.

5. The Future of Bitcoin

Looking ahead, Bitcoin’s future appears promising, though it will likely face ongoing challenges related to scalability, energy consumption, and regulatory issues. As more institutional investors and businesses adopt Bitcoin, its role as a store of value and a medium of exchange will continue to expand. The development of Layer 2 solutions like the Lightning Network will help address scalability concerns, while efforts to reduce Bitcoin’s environmental impact may enhance its appeal.

Bitcoin’s status as the largest and most influential cryptocurrency is unlikely to change in the near term, as its network effects, security features, and limited supply continue to make it a valuable asset. Whether Bitcoin can achieve mainstream adoption and become a global reserve currency remains to be seen, but its impact on the world of finance and digital assets is undeniable.

6. Conclusion

Bitcoin remains the most influential and valuable cryptocurrency, with a profound impact on the financial world. Its decentralized nature, innovative blockchain technology, and limited supply make it an attractive alternative to traditional assets. While challenges such as scalability, energy consumption, and regulation exist, the continued development of Layer 2 solutions and the growing adoption of Bitcoin by institutional investors suggest that Bitcoin’s role in the global financial system will only continue to grow.

As the cryptocurrency ecosystem evolves, Bitcoin will likely continue to set the standard for other digital currencies, shaping the future of decentralized finance and transforming how we think about money and value in the digital age.