Cryptocurrency markets have captured the world’s attention in recent years, becoming a dominant force in the global financial ecosystem. With Bitcoin, Ethereum, and other altcoins reaching new highs and breaking records, digital currencies are no longer just a niche investment— they are central to discussions about the future of finance. However, the one constant that remains in the cryptocurrency space is its extreme volatility. While this volatility has created substantial opportunities for traders, it has also raised concerns for investors, both retail and institutional, who are wary of the inherent risks.

Cryptocurrency prices are notoriously unpredictable, sometimes swinging 10%, 20%, or more within a single day. This volatility is driven by several factors ranging from market sentiment to regulatory uncertainty and even macro-economic trends. But why does the cryptocurrency market experience such high levels of price fluctuations? What are the implications for investors, and how can they navigate this volatility?

This article will delve into the factors that contribute to volatility in cryptocurrency markets, the impact of volatility on investors, and the strategies that can be used to manage and mitigate risks. We will also explore the potential for greater market stability in the future as the cryptocurrency ecosystem matures.

1. The Nature of Cryptocurrency Volatility

1.1 Defining Volatility in the Financial Context

In financial markets, volatility refers to the extent to which an asset’s price fluctuates over a specific period. Higher volatility means a larger degree of price movement, while lower volatility indicates more stable prices. Volatility can be a double-edged sword: it creates opportunities for profit, but it also increases risk. In traditional markets like stocks or bonds, volatility is generally lower, driven by factors such as earnings reports, economic indicators, and geopolitical events. However, cryptocurrency markets are fundamentally different in nature, making them far more volatile.

Cryptocurrencies like Bitcoin, Ethereum, and smaller altcoins often experience extreme price movements, even within short timeframes. It is not uncommon to see a price drop of 10%, 20%, or more within 24 hours, sometimes without any clear fundamental reason. This kind of volatility is both a source of investment opportunity and investment risk, making it essential for investors to carefully navigate the crypto markets.

1.2 Speculation: The Driving Force Behind Volatility

One of the key contributors to cryptocurrency market volatility is speculation. A significant portion of cryptocurrency trading is driven by short-term traders and speculators, who aim to profit from rapid price fluctuations rather than the long-term fundamentals of the asset. These traders are often influenced by news, social media, price trends, and market sentiment, which can cause sudden and dramatic price swings.

Unlike traditional markets, where prices are often driven by earnings reports, dividends, and long-term growth potential, cryptocurrencies do not have such fundamental valuation metrics. As a result, their prices are heavily influenced by emotional trading, news cycles, and broader market psychology. The frequent FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt) that dominate crypto markets further exacerbate volatility, as large numbers of retail investors react impulsively to news and market trends.

1.3 Limited Market Liquidity

Liquidity refers to how easily an asset can be bought or sold without affecting its price. In cryptocurrency markets, many assets—especially smaller altcoins—suffer from low liquidity, which can contribute to extreme price swings. Low liquidity means that a small trade can cause significant price movements, as there aren’t enough buyers or sellers to absorb the volume of a single transaction without impacting the price.

This lack of liquidity is especially evident in lesser-known altcoins that may not have deep market pools. A single large buy or sell order can drastically move the price, creating a volatile market environment. As more institutional players enter the market and liquidity improves, volatility may be mitigated somewhat, but smaller cryptocurrencies will likely continue to experience price swings.

2. Key Drivers of Cryptocurrency Market Volatility

2.1 Regulatory Uncertainty

One of the most significant contributors to volatility in cryptocurrency markets is regulatory uncertainty. Since their inception, cryptocurrencies have existed in a gray area with respect to regulation, and governments worldwide continue to debate how best to regulate them. Countries such as China, India, and Russia have introduced and sometimes rescinded regulations related to cryptocurrency trading, mining, and Initial Coin Offerings (ICOs). These regulatory moves can lead to sudden price changes.

For example, in 2021, when China announced a ban on cryptocurrency mining and trading, Bitcoin’s price plummeted by over 50%. Similarly, when governments propose new tax regulations or AML (anti-money laundering) policies, investors often react by selling off their holdings, fearing stricter oversight or enforcement. Such regulatory news can lead to increased market volatility, as investors try to anticipate the future regulatory environment and adjust their positions accordingly.

2.2 Market Sentiment and News Influence

Unlike traditional assets, where prices are driven by a combination of fundamentals and economic data, cryptocurrencies are largely sentiment-driven. The market’s perception of news, announcements, and trends often leads to rapid price swings. Positive news can fuel massive price surges, while negative news can lead to panic selling and steep declines.

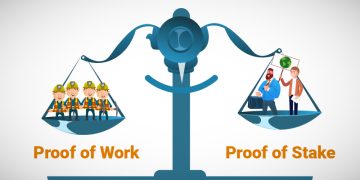

For example, when prominent figures such as Elon Musk or Jack Dorsey make public statements about Bitcoin or other cryptocurrencies, the market reacts quickly—either pushing prices higher or causing a dramatic sell-off. Similarly, announcements of partnerships, exchange listings, or technological developments (such as Ethereum’s transition to Proof of Stake) can cause massive price jumps, driven by speculative buying.

Conversely, regulatory crackdowns, security breaches, or news of hacking incidents can create negative sentiment, triggering price declines. The decentralized nature of the cryptocurrency space means that it is particularly vulnerable to rumors and misinformation, amplifying volatility.

2.3 Whale Movements and Market Manipulation

The cryptocurrency market is heavily influenced by whales, or individuals and entities who hold a significant amount of a particular cryptocurrency. Whales can manipulate the market by making large buy or sell orders, causing substantial price swings. A whale deciding to offload a large portion of their holdings can trigger a flash crash, while a whale buying up a cryptocurrency can lead to an unsustainable price spike.

Market manipulation is more prevalent in cryptocurrency markets due to the decentralized nature of the market, the anonymity of participants, and the absence of a central authority regulating trades. Pump and dump schemes—where whales artificially inflate the price of a cryptocurrency to sell at a profit, only to watch the price crash once the manipulation ends—are common in smaller altcoins. Such practices contribute to market volatility and make it harder for regular investors to predict price movements.

2.4 Macroeconomic Factors

Cryptocurrencies, despite being a relatively new asset class, are not immune to broader macroeconomic trends. Factors such as interest rates, inflation, and global financial crises can impact investor sentiment toward cryptocurrencies. For instance, during periods of economic uncertainty, cryptocurrencies like Bitcoin are sometimes viewed as a safe haven asset, akin to digital gold.

During times of financial instability, investors may turn to Bitcoin and other cryptocurrencies as a hedge against traditional market risks, such as inflation or currency devaluation. This can lead to a surge in prices. However, when the global economy stabilizes or interest rates rise, cryptocurrencies may lose their appeal as a speculative asset, contributing to price drops.

3. Impact of Cryptocurrency Volatility on Investors

3.1 Risks for Retail Investors

For retail investors, cryptocurrency market volatility presents both opportunities and risks. The allure of huge profits has led many individuals to enter the market, hoping to capitalize on price fluctuations. However, the volatility that accompanies these potential profits also exposes retail investors to significant risks.

Emotional trading often exacerbates the impact of volatility. Retail investors may panic sell during price declines, fearing further losses, only to watch the market rebound shortly afterward. Similarly, FOMO (fear of missing out) can drive investors to buy into a cryptocurrency during a price surge, only to face steep losses when the price corrects.

Volatility also makes it challenging to assess the intrinsic value of cryptocurrencies. Unlike traditional assets, which can be valued using well-established metrics such as earnings or dividends, cryptocurrencies often lack clear valuation benchmarks, making it difficult for investors to determine whether a particular asset is overpriced or undervalued.

3.2 Strategies for Institutional Investors

While retail investors may be more susceptible to emotional reactions to market volatility, institutional investors are generally better equipped to manage these risks. Institutional investors, such as hedge funds, family offices, and venture capital firms, use advanced risk management strategies to mitigate the risks of volatility.

One such strategy is hedging, where institutions use financial instruments such as futures contracts or options to protect against adverse price movements. By using these derivative instruments, institutions can lock in a price or limit their exposure to price fluctuations.

Furthermore, institutional investors tend to have longer investment horizons, which allows them to weather short-term volatility in anticipation of long-term growth. They also often engage in diversification, allocating their portfolios across a range of assets, including both cryptocurrencies and traditional investments, to spread risk.

4. Managing Volatility: Strategies for Cryptocurrency Investors

4.1 Dollar-Cost Averaging (DCA)

One of the most popular strategies for managing cryptocurrency market volatility is **Dollar-Cost Averaging (D

CA)**. This strategy involves investing a fixed amount of money into a cryptocurrency at regular intervals, regardless of its price. Over time, this strategy helps investors avoid the pitfalls of trying to time the market, as it smooths out the impact of short-term price fluctuations.

By purchasing cryptocurrency at regular intervals, DCA ensures that investors buy more when prices are low and fewer when prices are high. This can reduce the average cost per unit over time, mitigating the impact of volatility and making it easier to stick to a long-term investment plan.

4.2 Hedging with Derivatives

For more experienced investors, hedging with derivatives such as futures contracts, options, and perpetual swaps can help manage exposure to cryptocurrency price swings. These financial instruments allow investors to lock in future prices, hedge against downside risk, or amplify potential returns.

While derivatives can be powerful tools for managing volatility, they also come with their own set of risks. Improper use or over-leveraging can lead to significant losses, so investors must have a clear understanding of how these products work before utilizing them.

4.3 Diversification

Diversifying a portfolio across a range of cryptocurrencies, traditional assets, and other investment vehicles can help mitigate the risks associated with volatility. By not putting all investments in a single asset class, investors reduce the impact of any single asset’s price fluctuations.

Cryptocurrency-specific diversification can also help. By investing in Bitcoin, Ethereum, and other established cryptocurrencies, as well as emerging DeFi projects or layer-2 solutions, investors can spread risk across a broader range of assets. However, this strategy requires deep market knowledge and research to ensure that the assets chosen align with the investor’s risk tolerance and investment goals.

Conclusion

The volatility of the cryptocurrency market remains one of the central concerns for investors. While volatility can create opportunities for significant profits, it also exposes investors to substantial risks. Factors such as speculation, market sentiment, regulatory uncertainty, and low liquidity contribute to this volatility, making it essential for investors to approach the market with caution.

For retail investors, managing volatility requires a long-term perspective, sound risk management strategies like Dollar-Cost Averaging, and a well-diversified portfolio. Institutional investors, on the other hand, often rely on advanced tools like derivatives and hedging strategies to navigate volatility more effectively.

As the cryptocurrency market matures, increased regulation, improved liquidity, and broader adoption could potentially reduce volatility over time. However, the speculative nature of the market means that volatility is likely to remain a defining characteristic of cryptocurrencies for the foreseeable future.

Ultimately, investors must balance the potential for high returns with the understanding that volatility is an inherent part of the cryptocurrency landscape. For those willing to take on the risk, the rewards can be significant, but only if they approach the market with careful consideration and a solid strategy.