Introduction

The cryptocurrency market has become a powerful force in the global financial ecosystem. However, it has also introduced numerous challenges, particularly in terms of protecting investors. The inherent volatility of crypto assets, the lack of centralized oversight, and the emerging nature of blockchain technology create a breeding ground for fraudulent activities and risks. As cryptocurrencies evolve, the need for effective investor protection mechanisms has become a critical issue that must be addressed for the market’s sustainable growth and integration into the global financial system.

In this article, we will explore the key challenges in protecting crypto investors, the existing regulatory frameworks, and the potential solutions to establish effective investor protection mechanisms in the cryptocurrency market. By examining global best practices and providing actionable recommendations, we aim to guide the development of a safer, more transparent crypto ecosystem.

The Current State of the Crypto Market

Before delving into investor protection mechanisms, it is crucial to understand the nature of the crypto market and the challenges investors face.

- Market Volatility

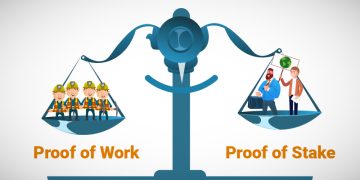

Cryptocurrency markets are notoriously volatile, with assets such as Bitcoin and Ethereum experiencing wild price swings within short periods. This volatility can lead to significant gains for investors but also devastating losses. Unlike traditional financial assets, crypto assets do not have a centralized authority to stabilize or regulate prices, which makes the market particularly prone to manipulation and sudden crashes. - Lack of Regulation

One of the defining characteristics of the crypto market is its decentralized nature. While this decentralization brings benefits such as greater financial inclusion and privacy, it also leaves investors vulnerable to scams, fraud, and bad actors. The lack of clear and universal regulatory guidelines makes it difficult to hold anyone accountable for investor losses, leaving participants to navigate a complex, sometimes hazardous landscape. - Fraud and Scams

The crypto space has seen numerous high-profile scams, including Ponzi schemes, rug pulls, and phishing attacks. These scams often target inexperienced investors who may lack the knowledge to identify fraudulent activities. Additionally, the irreversible nature of cryptocurrency transactions means that once funds are lost, they cannot be recovered. - Complexity and Lack of Investor Education

The crypto market is highly technical and complex, making it difficult for the average investor to fully understand the risks involved. Many investors may not be aware of the technological, security, and regulatory challenges associated with cryptocurrencies. This lack of education can result in poor investment decisions and susceptibility to fraud. - Inadequate Security Measures

Security breaches and hacks have been a recurrent issue in the crypto industry. High-profile incidents, such as the Mt. Gox hack in 2014 and more recent attacks on decentralized finance (DeFi) platforms, have resulted in billions of dollars in losses. While blockchain technology itself is considered secure, the platforms and exchanges that facilitate crypto transactions are often vulnerable to cyberattacks.

Challenges in Establishing Investor Protection

Several factors contribute to the difficulty in building robust investor protection mechanisms in the cryptocurrency market:

- Decentralization

The decentralized nature of cryptocurrencies presents a challenge to traditional regulatory approaches. Unlike centralized financial systems, where there are clear parties responsible for investor protection, crypto transactions occur peer-to-peer, with no single authority overseeing the process. This lack of a central authority complicates the enforcement of investor protection laws. - Global Jurisdictional Issues

The crypto market operates across borders, and as a result, regulatory oversight often varies significantly from country to country. For example, some nations have implemented strict regulations for cryptocurrency trading, while others have adopted a more relaxed or even hostile stance. This inconsistency makes it difficult to implement a universal investor protection mechanism. - Technological Risks

Blockchain and smart contract technologies are still evolving. While they offer many benefits, including transparency and immutability, they are also prone to vulnerabilities and coding errors. Bugs in smart contracts, lack of auditing, and exploits in DeFi protocols can put investors at risk. - Investor Behavior

Investors in the crypto market are often attracted by the promise of high returns, sometimes without fully understanding the associated risks. The psychology of greed can lead individuals to make speculative investments, and the FOMO (Fear of Missing Out) phenomenon can further fuel irrational decision-making. Regulating investor behavior and providing adequate safeguards is a complex task that involves not just legal measures but also cultural shifts in how people approach investment.

Existing Regulatory Frameworks and Investor Protection

While global regulation for cryptocurrencies is still in its infancy, various countries and regions have begun to implement regulations aimed at protecting investors:

- United States

The U.S. has taken a fragmented approach to crypto regulation. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are responsible for regulating certain aspects of the crypto market. However, the absence of comprehensive, clear guidelines has led to confusion and regulatory uncertainty. The recent push for a Crypto Market Infrastructure Bill aims to improve clarity and provide a regulatory framework for digital assets. - European Union

The EU has been more proactive in regulating cryptocurrencies. The Markets in Crypto-Assets (MiCA) regulation is set to establish a comprehensive regulatory framework for crypto assets, focusing on transparency, investor protection, and the prevention of market abuse. MiCA also seeks to ensure that crypto market participants adhere to AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations. - Asia

Countries like Japan and South Korea have taken a relatively progressive approach to crypto regulation. Japan’s Financial Services Agency (FSA) has implemented a licensing system for crypto exchanges, requiring them to adhere to stringent AML/KYC measures. China, on the other hand, has banned cryptocurrency mining and trading, reflecting a more cautious and restrictive approach. - Global Initiatives

International organizations, such as the Financial Action Task Force (FATF), have started to create guidelines to ensure that crypto markets adhere to AML/KYC standards. The FATF’s Travel Rule, which mandates that crypto exchanges share information about their customers’ transactions, is an example of an international effort to ensure accountability and transparency in crypto transactions.

Solutions to Strengthen Investor Protection

To address the current gaps and build a more secure and transparent crypto ecosystem, several solutions can be implemented:

- Comprehensive Global Regulatory Framework

The creation of a global regulatory framework is crucial for investor protection. While each country will have its own specific needs and conditions, a common set of guidelines—such as uniform rules for KYC/AML, fraud prevention, and transparency—can provide a basis for international cooperation. This would help mitigate the risks associated with cross-border crypto transactions and ensure that investors are protected globally. - Enhanced Security Protocols

Crypto exchanges and platforms must invest heavily in cybersecurity measures, including multi-factor authentication (MFA), encryption, and cold storage solutions. Regular security audits and vulnerability testing should be standard practice. Moreover, DeFi protocols and smart contracts should undergo thorough auditing before being deployed on the blockchain to minimize the risk of exploits and hacks. - Investor Education and Awareness

Education is one of the most powerful tools in protecting investors. Governments, financial institutions, and blockchain projects should work together to create educational resources that help individuals understand the risks of investing in cryptocurrencies. These resources should cover topics such as market volatility, security practices, regulatory requirements, and how to identify potential scams. - Decentralized Insurance Solutions

DeFi platforms could explore the development of decentralized insurance solutions to cover investor losses in case of fraud or technical failures. These insurance solutions could provide an added layer of protection and ensure that investors have some recourse in the event of unforeseen issues. - Regulation of Stablecoins

Stablecoins, which are widely used in crypto markets, should be regulated to ensure that they are backed by sufficient reserves and adhere to transparent accounting practices. Regulatory bodies should require stablecoin issuers to conduct regular audits and disclose their reserves to protect investors from potential de-pegging or insolvency risks. - Smart Contract Standards

The development of universal smart contract standards can help reduce risks associated with poorly coded or vulnerable contracts. Standardization would allow for better interoperability across platforms and ensure that investors can interact with contracts that have been thoroughly tested and are less likely to be exploited.

Conclusion

Investor protection in the cryptocurrency market is a complex issue that requires a multi-faceted approach. The lack of central authority, regulatory uncertainty, and the technical complexities of the blockchain ecosystem make it difficult to implement universal protections. However, with the right combination of global regulations, enhanced security measures, investor education, and technological advancements, it is possible to build a more secure and transparent crypto market. As the industry continues to mature, the implementation of strong investor protection mechanisms will be crucial for fostering trust and ensuring the long-term success of the crypto market.

By addressing these challenges, we can pave the way for a safer and more sustainable digital asset ecosystem that benefits both investors and the broader global economy.