Introduction

Financial management has always been a cornerstone of any successful business. In today’s increasingly complex and digital world, businesses face the challenge of ensuring that financial transactions are accurate, transparent, and compliant with regulatory requirements. Traditionally, financial management relied on centralized systems, where records were stored in centralized databases managed by financial institutions or internal departments. However, this model has inherent flaws, such as the risk of fraud, data manipulation, and inefficiency in cross-border transactions.

Enter Distributed Ledger Technology (DLT)—the backbone of Enterprise Chains, which is transforming the financial management landscape. By decentralizing data storage, providing real-time updates, and ensuring the integrity of financial records, Enterprise Chains have emerged as a powerful tool in improving transparency, reducing fraud, and enhancing audit efficiency.

This article delves into how Enterprise Chains—powered by DLT—are enhancing financial management by improving transparency, speeding up audits, and providing immutable, verifiable, and real-time financial data.

1. Understanding Distributed Ledger Technology (DLT)

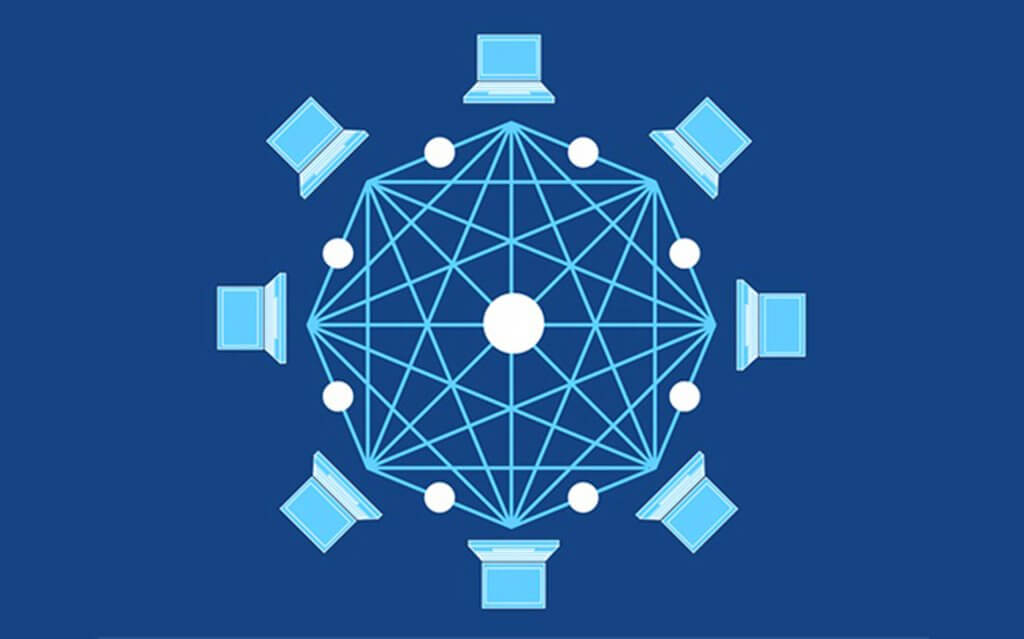

To comprehend how DLT is revolutionizing financial management, it is essential to understand what DLT is and how it works. At its core, Distributed Ledger Technology (DLT) is a decentralized database system that allows multiple participants (or nodes) in a network to maintain and update an identical copy of a ledger in real-time. The distributed nature of DLT ensures that no single participant has full control over the data. Instead, all participants collaborate to validate, record, and store transactions.

One of the most well-known applications of DLT is Blockchain. While blockchain is a type of DLT, not all DLTs are blockchain-based. The primary features that DLTs share include:

- Decentralization: No single entity has control over the data. Instead, it is maintained by a network of nodes.

- Immutability: Once data is recorded on the ledger, it cannot be altered or tampered with, ensuring data integrity.

- Transparency: All participants have access to the same version of the ledger, making transactions transparent and verifiable.

- Security: Transactions are cryptographically secure, protecting them from unauthorized access or tampering.

2. Enterprise Chains and Their Role in Financial Management

An Enterprise Chain is a private or consortium blockchain specifically designed for enterprise use. It is tailored to meet the needs of businesses, enabling them to use blockchain’s security and transparency features while maintaining control over who participates in the network.

The key difference between public and enterprise blockchains lies in the participants’ access and control. While public blockchains like Bitcoin and Ethereum are open to anyone, enterprise chains are permissioned networks. These networks allow only authorized entities to participate, making them more suitable for businesses that require privacy and compliance with industry regulations.

Enterprise chains, using DLT, are becoming increasingly popular in the financial services industry for their ability to:

- Enhance transparency of financial transactions

- Streamline audits and reduce costs associated with traditional auditing

- Improve security and reduce the risk of fraud or data manipulation

- Automate processes through smart contracts

- Ensure regulatory compliance with real-time data sharing

3. Improving Transparency in Financial Transactions

In traditional financial systems, transparency has always been a challenge. Financial data is often siloed within individual institutions, creating barriers to visibility. For example, financial transactions between companies or between companies and customers can be difficult to track, and it is often unclear whether each party is fulfilling their obligations. This lack of transparency can lead to discrepancies, fraud, and inefficiencies.

By utilizing Enterprise Chains, businesses can significantly enhance the transparency of their financial transactions. Here’s how:

3.1 Real-Time Updates and Shared Ledger

The decentralized nature of enterprise chains means that all participants in the network have access to the same version of the ledger, which is updated in real-time. Every financial transaction—whether it’s a payment, transfer of assets, or an invoice—gets recorded and instantly verified by the network. This provides unparalleled transparency, as each party involved can view the same data at the same time.

For instance, in a supply chain scenario, every time a transaction occurs—whether it’s the payment for goods or services or the transfer of assets—the transaction is recorded on the blockchain and visible to all authorized parties in real-time. This level of transparency helps companies avoid discrepancies and ensures that all transactions are auditable at any given moment.

3.2 Reduced Risk of Fraud and Data Tampering

The immutability of the blockchain ensures that once a transaction is recorded, it cannot be altered or deleted. This feature makes it nearly impossible for any participant to tamper with financial data. If a fraudulent transaction were to occur, it would be easily traceable and verifiable, which reduces the likelihood of fraud within the system.

In addition, the use of cryptographic techniques such as digital signatures ensures that only authorized parties can approve or modify transactions, further protecting financial data from malicious actors.

4. Enhancing Audit Efficiency with Enterprise Chains

Traditional financial audits are often time-consuming, costly, and error-prone. Auditors must manually gather data from multiple systems, cross-check it for accuracy, and ensure that it aligns with the company’s financial records. The audit process also involves a lot of paperwork and extensive documentation, which can be both inefficient and costly for businesses.

Enterprise Chains, however, offer a more efficient, automated, and transparent way to conduct financial audits. Here’s how:

4.1 Real-Time and Automated Audits

In an Enterprise Chain, financial transactions are recorded in real-time, and each transaction is time-stamped and immutable. This real-time nature allows auditors to continuously monitor transactions, reducing the need for periodic audits. Auditors can access the ledger at any time and track all transactions as they occur, improving the overall audit efficiency.

Additionally, the use of smart contracts allows for the automation of routine audit tasks. For example, businesses can create smart contracts that automatically trigger audits whenever specific conditions are met (e.g., once a transaction exceeds a certain threshold). This reduces the need for manual intervention and streamlines the auditing process.

4.2 Transparency and Traceability of Financial Data

Enterprise Chains provide an unparalleled level of traceability. Each transaction on the blockchain is linked to the previous one, forming an immutable chain of events. This makes it easy for auditors to trace the entire financial history of a company, ensuring that no data is missing and that all transactions align with the company’s financial records.

Auditors can also verify the authenticity of transactions in real-time, ensuring that financial reports are accurate and reflect the true state of a company’s finances. This reduces the potential for discrepancies and fraud and makes audits more efficient and cost-effective.

4.3 Enhanced Regulatory Compliance

The financial sector is heavily regulated, and businesses must comply with a variety of rules and regulations. Traditional systems often make it challenging for businesses to demonstrate compliance, especially when dealing with cross-border transactions and multiple regulatory bodies.

Enterprise Chains enable businesses to maintain continuous, transparent records of all financial transactions, which can be easily shared with regulators. This makes it easier for companies to comply with industry regulations, such as Know Your Customer (KYC), Anti-Money Laundering (AML), and General Data Protection Regulation (GDPR), as all transactions are recorded in a transparent and auditable manner.

Additionally, real-time access to the blockchain allows auditors and regulators to check the validity of financial records instantaneously, reducing the time and resources required for audits and ensuring compliance.

5. Case Studies: Real-World Implementation of Enterprise Chains in Financial Management

Several industries have begun adopting Enterprise Chains to enhance transparency and improve audit efficiency. Let’s take a look at a few real-world examples:

5.1 Trade Finance and Supply Chain Management

In the field of trade finance, companies have been using Enterprise Chains to simplify the process of verifying transactions, reducing the need for paper-based documentation and improving transparency. For instance, we.trade, a blockchain-based platform, enables businesses to securely and transparently execute trade transactions in real-time. By recording all transactions on the blockchain, the platform enhances visibility for all parties involved, providing a tamper-proof record of transactions and simplifying the audit process.

5.2 Cross-Border Payments

Cross-border payments have historically been costly and inefficient due to intermediaries and complex financial networks. Ripple, a decentralized blockchain platform, has been used by banks and financial institutions to streamline international payments. Ripple’s blockchain allows businesses to conduct cross-border transactions in real-time, with full transparency. It significantly reduces the time and cost involved in traditional cross-border payments, while ensuring that all transactions are auditable and traceable.

5.3 Banking and Financial Institutions

In the banking sector, JPMorgan has launched its own blockchain-based platform called JPM Coin. This platform allows for secure, real-time payments between institutional clients, offering a more transparent and efficient alternative to traditional methods. JPM Coin enables financial institutions to send payments instantly and transparently while providing auditors with access to real-time transaction data.

6. Conclusion

As businesses increasingly adopt blockchain and Enterprise Chains in financial management, the benefits of improved transparency, enhanced audit efficiency, and strengthened security are becoming more apparent. By leveraging Distributed Ledger Technology (DLT), businesses can not only streamline their financial processes but also ensure regulatory compliance, reduce fraud, and maintain the integrity of their financial records.

As this technology continues to evolve, the role of Enterprise Chains in financial management will only grow stronger, offering businesses a more secure, efficient, and transparent way to handle financial transactions. The integration of blockchain into financial management systems is setting the stage for a new era of transparency, automation, and accountability in the financial sector. The future of financial audits and transactions is indeed on-chain, and the potential for innovation is limitless.