Introduction

Bitcoin, the first and most prominent cryptocurrency, has captured the imaginations of investors, technologists, and financial professionals across the globe. Since its creation in 2009 by the pseudonymous figure Satoshi Nakamoto, Bitcoin has undergone an incredible transformation—from an experimental idea to a mainstream asset class. Often referred to as “digital gold”, Bitcoin is lauded for its potential to store value, much like physical gold. However, its volatility, regulatory uncertainty, and security risks have raised concerns about its stability and long-term viability.

This article aims to explore Bitcoin’s intrinsic value, its comparison to gold, and the risks associated with Bitcoin as a store of value, currency, and investment asset. We will dive into the features of Bitcoin that support its value proposition, analyze the risks involved in its use, and provide insight into its potential future in the global financial ecosystem.

1. Understanding Bitcoin: The Birth of a New Digital Asset

1.1 The Creation of Bitcoin

Bitcoin was introduced to the world through a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System”, published by Satoshi Nakamoto in 2008. The concept behind Bitcoin was revolutionary: to create a decentralized digital currency that could allow for peer-to-peer transactions without relying on central banks, governments, or financial institutions. This was to be achieved using blockchain technology, which provides a distributed ledger of transactions, ensuring transparency and security without a central authority.

What distinguishes Bitcoin from traditional fiat currencies is its limited supply. There will only ever be 21 million Bitcoins in existence. This scarcity factor, along with Bitcoin’s decentralized and open-source nature, has led to its increasing comparison to gold—another asset that is valued for its scarcity and divisibility.

1.2 How Bitcoin Works

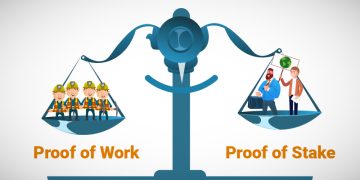

Bitcoin operates on a peer-to-peer network, facilitated by blockchain technology. Every Bitcoin transaction is recorded in blocks that are added to a public ledger, which is stored across multiple nodes in the network. The process of validating these transactions is carried out by miners, who compete to solve complex cryptographic puzzles. In return, miners are rewarded with newly created Bitcoins. This is known as Proof of Work.

Unlike fiat currencies, Bitcoin is not controlled or issued by a central bank. Instead, its supply is algorithmically limited, with the rate of new Bitcoins being halved approximately every four years in a process known as Bitcoin halving. As of now, over 18.7 million Bitcoins have already been mined, and the total supply will never exceed 21 million.

2. Bitcoin as Digital Gold

2.1 Bitcoin’s Limited Supply and Scarcity

One of the most compelling arguments for Bitcoin’s comparison to gold is its scarcity. Gold is rare and can’t be artificially created, which has historically given it value as a store of wealth. Similarly, Bitcoin’s supply is finite, capped at 21 million coins. This fixed supply gives Bitcoin a deflationary quality that contrasts with inflationary fiat currencies. Unlike governments that can print more money at will, Bitcoin’s supply is predetermined and cannot be increased beyond its set limit.

Bitcoin’s halving events (which occur approximately every four years) gradually reduce the reward miners receive for processing transactions. This diminishing supply, combined with rising demand, could further contribute to Bitcoin’s price appreciation over time.

2.2 Bitcoin’s Store of Value

A store of value is an asset that preserves its purchasing power over time, offering a hedge against inflation and economic instability. Gold has traditionally fulfilled this role for centuries, and more recently, Bitcoin has been touted as a digital store of value. As traditional markets become more volatile, particularly during times of economic uncertainty, Bitcoin has gained recognition as a potential hedge against inflation, much like gold.

Bitcoin’s scarcity, the decentralized nature of its network, and the lack of control by any central authority make it an attractive alternative to fiat currencies. For example, during economic downturns or periods of monetary policy uncertainty, Bitcoin has acted as a safe haven for investors, as its value is not directly impacted by government decisions, unlike traditional currencies.

2.3 Bitcoin as a Hedge Against Inflation

Inflationary pressure is a persistent concern for fiat currencies, as governments and central banks can print more money to cover deficits. This can erode the value of fiat currencies over time. Bitcoin, on the other hand, is deflationary by design, with its fixed supply and periodic halving events. As inflation increases and currencies lose purchasing power, Bitcoin becomes more appealing as a store of value.

Example: Countries experiencing hyperinflation, such as Venezuela or Argentina, have seen a significant rise in Bitcoin adoption as people seek alternatives to their weakening national currencies. Bitcoin provides these populations with an accessible and inflation-resistant asset.

3. The Value Proposition of Bitcoin

3.1 Bitcoin in the Modern Financial System

Bitcoin offers a decentralized alternative to the traditional banking and financial systems. It operates without intermediaries, meaning individuals can transact directly with one another, regardless of their geographic location. Bitcoin transactions are secure, fast, and cost-effective, allowing for peer-to-peer (P2P) transfers without the need for third-party institutions like banks.

Bitcoin is also programmable, meaning developers can build decentralized applications (DApps) and financial products on top of the Bitcoin blockchain. Additionally, Bitcoin has inspired the development of DeFi (Decentralized Finance) platforms, which facilitate financial services such as lending, borrowing, and insurance, all without relying on traditional banks.

3.2 Bitcoin as a Global Currency

Bitcoin is borderless and can be used anywhere in the world, making it an ideal candidate for a global currency. Unlike fiat currencies, which are subject to exchange rate fluctuations and government control, Bitcoin operates on a global decentralized network that allows for easy and instant cross-border transactions. This makes it an attractive solution for international trade and remittances, especially in regions where traditional banking infrastructure is inadequate or expensive.

Bitcoin is also divisible, meaning even small amounts can be transferred easily. A single Bitcoin can be divided into 100 million smaller units, called satoshis, allowing for micro-transactions, which is something traditional gold cannot achieve.

3.3 Institutional Adoption of Bitcoin

In recent years, institutional investors have increasingly turned to Bitcoin as an asset class. MicroStrategy, Tesla, and Square are just a few of the prominent companies that have purchased Bitcoin and added it to their balance sheets. As institutional adoption grows, Bitcoin is becoming more legitimized in the traditional financial world, leading to further price appreciation and mainstream recognition.

Example: In 2021, El Salvador became the first country to adopt Bitcoin as legal tender. This move, which was a significant milestone for Bitcoin’s global adoption, allowed Salvadorans to use Bitcoin for everything from paying taxes to purchasing goods and services.

4. The Risks and Challenges of Bitcoin

While Bitcoin offers numerous advantages, it also comes with significant risks and challenges that need to be carefully considered.

4.1 Volatility

One of the most notable drawbacks of Bitcoin is its price volatility. Bitcoin’s value can fluctuate dramatically in a short period, making it a risky asset for investors. While it has experienced substantial long-term growth, short-term swings can be unsettling for many investors.

For instance, Bitcoin reached an all-time high of $69,000 in late 2021, only to experience a steep decline in 2022. Such volatility is a hallmark of Bitcoin’s nascent stage in the financial ecosystem, and its price could continue to be unstable in the short to medium term.

4.2 Regulatory Uncertainty

Bitcoin’s decentralized nature makes it challenging for governments to regulate. This has raised concerns regarding its potential use in illegal activities such as money laundering and terrorist financing. In response, countries like China have imposed outright bans on Bitcoin and cryptocurrency mining, while other governments have been hesitant to embrace it fully.

The evolving regulatory landscape remains one of the greatest uncertainties for Bitcoin’s future. If major governments impose strict regulations or ban Bitcoin entirely, it could have a severe impact on its price and adoption.

4.3 Security Risks

While Bitcoin’s blockchain is highly secure, the security of user wallets is another matter. Losing private keys or falling victim to phishing attacks could result in the permanent loss of Bitcoin holdings. Moreover, centralized exchanges that store Bitcoin on behalf of users are often targeted by hackers, as demonstrated by several high-profile exchange hacks.

4.4 Environmental Impact

Bitcoin mining is an energy-intensive process that requires significant computational power. Bitcoin’s energy consumption has raised concerns about its environmental impact, especially in the context of global efforts to combat climate change. Mining operations often rely on cheap electricity, which in some cases is sourced from fossil fuels.

Example: Bitcoin’s environmental footprint has led to debates about the sustainability of mining operations, with some advocating for the use of renewable energy to power mining activities.

5. The Future of Bitcoin

5.1 Mass Adoption and Global Integration

As Bitcoin continues to evolve, it is likely to see more global adoption in both developed and developing markets. Widespread adoption could lead to the creation of more Bitcoin-based financial products, such as exchange-traded funds (ETFs), Bitcoin-backed loans, and Bitcoin-focused investment funds, making it more accessible to both retail and institutional investors.

Additionally, Bitcoin’s role in DeFi and other blockchain-based innovations could cement its place as an integral part of the global financial system.

5.2 Bitcoin as

a New Monetary Standard

Some visionaries argue that Bitcoin could become a new global monetary standard, potentially replacing fiat currencies or serving as a reserve asset alongside gold. While this is still a distant possibility, Bitcoin’s role as a store of value and global currency could reshape how money is perceived and utilized in the digital age.

Conclusion

Bitcoin has already established itself as a groundbreaking asset that offers an alternative to traditional financial systems. As digital gold, Bitcoin offers scarcity, security, and the potential for long-term value preservation. However, its price volatility, regulatory uncertainties, and security concerns present challenges that must be addressed before Bitcoin can reach its full potential.

Ultimately, Bitcoin’s future will depend on its ability to overcome these risks while maintaining its core advantages. Whether it evolves into a global reserve asset, becomes a mainstream currency, or remains a niche investment vehicle, Bitcoin’s impact on the global financial system will continue to unfold in the coming years.