Introduction

Blockchain technology, with its decentralized nature, promises to reshape industries by removing intermediaries, ensuring transparency, and enabling peer-to-peer transactions. While it has brought about numerous innovations in fields like finance (e.g., cryptocurrencies), supply chain management, and healthcare, one of its fundamental challenges lies in ensuring that the interests of all stakeholders in a blockchain network are balanced.

In traditional systems, centralized entities, such as banks or governments, often make decisions on behalf of the stakeholders, ensuring fairness and addressing conflicting interests. However, in a decentralized system, blockchain governance becomes more complex. Without a central authority, how can we ensure that no single participant (be it a miner, validator, developer, or user) can dominate the network, potentially leading to unfair advantages or disruptions?

This article examines the core principles of balancing interests in blockchain networks, explores the mechanisms through which this can be achieved, and offers suggestions on how various stakeholders—miners, developers, users, and regulators—can work together to maintain fairness and equality.

1. The Core Stakeholders in Blockchain Networks

To understand how to balance interests, it is essential to first define the key stakeholders in any blockchain network:

a. Miners/Validators

Miners (in proof-of-work blockchains) or validators (in proof-of-stake blockchains) are responsible for validating transactions and securing the network. In return, they are rewarded with tokens or cryptocurrency for their efforts. However, these incentives can sometimes lead to centralization of power, especially if a small group of miners controls a disproportionate amount of the network’s computational or staking power.

b. Developers

Developers play a crucial role in creating, maintaining, and upgrading blockchain protocols. They often influence the direction of the network through software updates and governance decisions. Developers also set the rules and standards for smart contracts, consensus mechanisms, and scalability solutions.

c. Users

Users are the individuals or entities who utilize the blockchain for various purposes, such as sending transactions, creating smart contracts, or participating in decentralized applications (dApps). They are often the largest group of stakeholders but generally have the least direct control over the network’s governance.

d. Regulators

Regulators are government bodies or international organizations that oversee the use of blockchain technology and digital assets. As blockchain grows in prominence, regulators are increasingly involved in ensuring compliance with laws, especially in areas like anti-money laundering (AML), taxation, and consumer protection.

e. Token Holders

In many blockchain networks, participants who hold the native token (such as Bitcoin or Ether) have a vested interest in the success of the network. In some governance models, token holders may be able to vote on protocol upgrades or other significant changes, making them an influential stakeholder group.

2. Governance Models and Their Role in Balancing Interests

The governance model of a blockchain network plays a critical role in ensuring that the interests of all stakeholders are adequately represented. Broadly speaking, governance refers to the mechanisms, processes, and rules that guide the decision-making and operations of the blockchain. Several governance models exist:

a. On-Chain Governance

On-chain governance allows stakeholders (usually token holders) to directly vote on protocol upgrades, network parameters, and other key decisions. This system promotes democratic participation and gives users a more direct voice in the direction of the blockchain.

- Example: The Tezos blockchain employs on-chain governance, where token holders vote on proposed changes to the protocol. This system aims to reduce contentious forks and improve the efficiency of decision-making.

However, challenges arise when a small group of holders control a disproportionate amount of tokens, leading to a centralized voting system. This undermines the democratic principles of blockchain and can skew decision-making in favor of larger, wealthier participants.

b. Off-Chain Governance

In off-chain governance, decisions are made through forums, community discussions, and proposals, rather than directly via blockchain transactions. Key stakeholders, such as developers, miners, and token holders, engage in a more informal process of debate and consensus-building.

- Example: Bitcoin follows an off-chain governance model, with decisions made through Bitcoin Improvement Proposals (BIPs) and discussions within the broader community. While this allows for broad input from different stakeholders, it can be slow and subject to factional disputes.

Off-chain governance models can be prone to centralization of power, as those with the most influence (such as miners or developers) often have the final say in decisions, leaving smaller stakeholders with limited say.

c. Delegated Governance

Delegated governance combines on-chain and off-chain elements by allowing stakeholders to elect representatives or delegates who vote on their behalf. This method aims to streamline decision-making while still maintaining a degree of decentralization.

- Example: EOS uses a delegated proof-of-stake (DPoS) model, where a select number of block producers are elected to validate transactions and make key governance decisions. This balances efficiency with stakeholder input, though it can still be susceptible to centralization.

The main risk with delegated governance is that a small group of delegates may become too powerful, potentially prioritizing their interests over the wider community’s.

3. Incentive Structures: Aligning Stakeholder Interests

Incentives are the driving force behind blockchain networks. To ensure a balanced distribution of power and fair rewards, it is essential that the incentive structure is carefully designed. If the incentives are not aligned correctly, the network may become centralized, with a small group of participants reaping disproportionate rewards.

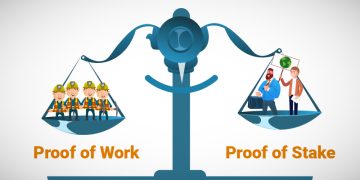

a. Proof-of-Work (PoW) vs. Proof-of-Stake (PoS)

- PoW: In proof-of-work systems like Bitcoin, miners compete to solve complex mathematical problems, with the first miner to solve it receiving a block reward. This system incentivizes the investment of computational power but can lead to centralization, as larger mining pools have more resources and can control the network.

- PoS: Proof-of-stake systems, such as Ethereum 2.0, give validators the opportunity to validate blocks and secure the network based on the number of tokens they hold and are willing to stake. While PoS systems require less energy than PoW, they can still lead to centralization if a few validators control a large proportion of staked tokens.

The key challenge for both models is ensuring that the incentives are distributed in such a way that no single participant or group can dominate the network. Well-designed staking mechanisms, reward distributions, and penalties for malicious behavior are crucial to maintaining fairness.

b. Fair Reward Distribution

Blockchain networks must ensure that rewards are distributed fairly among stakeholders. A fair reward distribution model can encourage participation and prevent the centralization of wealth. For example:

- Mining Pools and Staking Pools: Mining and staking pools can allow smaller participants to collaborate and earn a share of the rewards, helping to avoid the concentration of power in the hands of a few large miners or validators.

- Revenue Sharing: Some blockchain protocols introduce revenue-sharing models, where profits generated by the network (e.g., transaction fees) are shared more equitably among participants.

4. Preventing Centralization and Ensuring Fairness

Centralization is one of the most significant risks in blockchain governance and network operation. As larger entities accumulate more power, they may be able to sway decisions in their favor, leading to unfair outcomes. Several strategies can help mitigate centralization:

a. Mechanisms for Preventing Miner/Validator Cartels

One of the biggest risks in proof-of-work and proof-of-stake systems is the creation of mining or staking cartels. These cartels can collude to gain majority control over the network’s consensus mechanism, potentially leading to double-spending attacks, network censorship, or manipulation of rewards.

- Solution: Implementing difficulty adjustment mechanisms, using randomized block selection, or introducing liquidity pools for staking can help prevent collusion and promote fairness.

b. Incentivizing Decentralization

Blockchain networks can implement incentives for decentralization, such as rewarding smaller participants or penalizing large actors who control too much of the network’s power. For example:

- Block reward caps: Limiting the maximum reward that any one participant can receive within a certain time period could prevent large entities from monopolizing the rewards.

- Decentralized token distribution: Ensuring that tokens are distributed widely through airdrops, community incentives, and staking rewards can ensure that no single party controls a majority of the network’s assets.

5. The Role of Regulators in Ensuring Balance

Governments and regulatory bodies play an essential role in ensuring that the blockchain ecosystem remains balanced and fair. As blockchain technology continues to grow, regulators must find ways to ensure compliance with laws and ethical standards, while avoiding stifling innovation.

a. Anti-Money Laundering (AML) and Know Your Customer (KYC)

AML and KYC regulations ensure that blockchain networks cannot be easily exploited for illegal activities. By enforcing these standards, regulators can help maintain the integrity of the blockchain ecosystem and prevent malicious actors from exploiting its decentralized nature.

b. Regulatory Clarity

Regulators must create clear and transparent frameworks for blockchain-based businesses, particularly in areas like taxation, consumer protection, and data privacy. By ensuring regulatory certainty, they can help stakeholders make informed decisions and reduce the risks of unfair practices.

Conclusion

Ensuring that the interests of all stakeholders in a blockchain network are balanced requires careful attention to governance structures, incentive models, and regulatory oversight. By adopting transparent, inclusive, and fair governance models, aligning incentives, preventing centralization, and ensuring compliance with ethical standards, blockchain networks can provide a fair and equitable environment for all participants.

As blockchain technology continues to evolve, maintaining fairness will be crucial to its success. The balance of power, wealth, and governance in these networks must be constantly monitored and adjusted to ensure that they remain decentralized, transparent, and secure, fostering trust among stakeholders and encouraging broad adoption across industries.