The rise of Decentralized Finance (DeFi) represents one of the most significant shifts in the financial ecosystem in the 21st century. Built on the principles of decentralization, transparency, and open-source technology, DeFi leverages blockchain and smart contract technologies to create financial systems without intermediaries like banks or traditional financial institutions.

Since its inception, DeFi has rapidly expanded, revolutionizing the way financial services are provided. From lending and borrowing platforms to decentralized exchanges (DEX), DeFi has proven to be a game-changer, not only in the cryptocurrency space but in the entire financial sector.

This article explores the evolution of DeFi, its key components, its revolutionary impact on traditional finance, the challenges it faces, and the future outlook of this disruptive technology.

1. The Birth of DeFi: A New Era in Finance

1.1 What is DeFi?

Decentralized Finance (DeFi) refers to a suite of financial services that are built on blockchain technology and operate without traditional intermediaries, such as banks, credit institutions, or brokers. It encompasses a broad spectrum of financial services including lending, borrowing, trading, insurance, asset management, and more.

DeFi applications are typically built on public blockchains, most notably Ethereum, although other blockchain platforms like Binance Smart Chain (BSC), Solana, and Polkadot have also started hosting DeFi projects. By leveraging smart contracts, DeFi protocols automate and enforce transactions, eliminating the need for centralized control and intermediaries.

1.2 The Origin of DeFi

The roots of DeFi can be traced back to the creation of Bitcoin in 2009, which laid the groundwork for digital, peer-to-peer currency systems. However, it wasn’t until Ethereum was launched in 2015 by Vitalik Buterin and others that DeFi truly began to take shape. Ethereum introduced the concept of smart contracts, allowing for the development of decentralized applications (dApps) that could run on the blockchain and automate transactions without the need for intermediaries.

By 2017, the first wave of DeFi projects emerged, including decentralized exchanges (DEXs) like Uniswap and lending platforms like MakerDAO. These platforms allowed users to exchange digital assets, borrow or lend money, and engage in decentralized governance. However, it was in 2020 — during the DeFi summer — that the sector truly exploded, with billions of dollars in total value locked (TVL) into DeFi protocols.

2. Key Components of DeFi

DeFi encompasses a wide range of services and protocols, each designed to replicate traditional financial services using decentralized technologies. The core components of DeFi include:

2.1 Decentralized Exchanges (DEXs)

One of the earliest and most impactful DeFi innovations, DEXs are platforms that allow users to trade digital assets directly, without needing a central authority to match orders. Examples of popular DEXs include Uniswap, SushiSwap, and PancakeSwap.

These platforms typically use automated market makers (AMMs), which provide liquidity through smart contracts rather than relying on order books. By removing centralized control, DEXs offer greater transparency, security, and accessibility.

Key Features of DEXs:

- Permissionless trading: Anyone with an internet connection can trade.

- Liquidity Pools: Users provide liquidity to trading pairs and earn fees.

- Non-custodial: Users maintain control of their funds throughout the transaction process.

2.2 Lending and Borrowing Platforms

Lending and borrowing platforms allow users to lend their assets in exchange for interest or borrow assets by providing collateral. The MakerDAO protocol and Compound are two notable examples that enable decentralized lending.

These platforms operate on over-collateralization, meaning borrowers must deposit more value in collateral than they wish to borrow. Smart contracts automatically execute loans, ensuring transparency and eliminating the need for a credit score.

Key Features of Lending Protocols:

- No intermediaries: Loans are processed through smart contracts without a bank or traditional lender.

- Variable interest rates: Rates fluctuate depending on the supply and demand for assets in the platform.

- Collaterals: Users must collateralize their loans with digital assets, which can be liquidated if the value drops below the required threshold.

2.3 Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value, often pegged to a fiat currency such as the US dollar. These coins are crucial for maintaining price stability within the DeFi ecosystem.

Popular stablecoins like Tether (USDT), USD Coin (USDC), and Dai provide users with a reliable store of value while still allowing the flexibility and transparency of blockchain technology. Algorithmic stablecoins like Terra aim to maintain their peg without collateral by using algorithmic systems to control supply.

Key Features of Stablecoins:

- Price Stability: Pegged to a stable asset (e.g., USD).

- Efficiency: Can be used as a medium of exchange within DeFi protocols.

- Transparency: Transactions are recorded on the blockchain, providing transparency.

2.4 Yield Farming and Liquidity Mining

Yield farming and liquidity mining have become popular strategies within DeFi for earning rewards. Users can earn interest, tokens, or other rewards by providing liquidity to DeFi platforms.

In yield farming, liquidity providers (LPs) contribute funds to liquidity pools and earn rewards based on their share of the pool. Liquidity mining, often used synonymously, specifically refers to providing liquidity to earn native platform tokens.

Key Features of Yield Farming:

- Passive income: Liquidity providers earn rewards without actively trading.

- High yields: Some DeFi protocols offer high returns to incentivize liquidity provision.

- Risk: While yields can be high, so are the risks, including impermanent loss, smart contract vulnerabilities, and market volatility.

2.5 Insurance Protocols

DeFi has also expanded into the insurance space, creating decentralized platforms that provide coverage for smart contract risks, hacks, and other unforeseen events. Nexus Mutual is a leading platform that offers DeFi insurance.

Key Features of DeFi Insurance:

- Smart contract-based: Claims and payouts are automatically processed through smart contracts.

- Community-based: Claims are reviewed and approved by the community or token holders.

3. The Impact of DeFi on Traditional Finance

DeFi has introduced fundamental changes to traditional financial systems, which have often been dominated by centralized institutions. Some of the most significant impacts include:

3.1 Democratization of Financial Services

One of the core principles of DeFi is to offer open financial services to anyone with an internet connection. Traditional financial services are often inaccessible to underserved populations, including those in developing countries, or people who don’t have access to banking services.

DeFi eliminates these barriers, providing an inclusive financial system. With DeFi, anyone can participate in lending, borrowing, trading, and investing, regardless of their geographic location, socioeconomic status, or access to traditional financial institutions.

3.2 Financial Inclusion

DeFi platforms are being used to provide financial services in regions where traditional banking is inefficient or inaccessible. For example, DeFi lending allows people in developing countries to access loans without needing a credit score or physical banking infrastructure.

3.3 Reduced Costs and Increased Efficiency

By removing intermediaries, DeFi has significantly reduced the cost of financial services. Traditional financial systems often require transaction fees for services like remittances, money transfers, and foreign exchange. DeFi platforms reduce these fees by automating processes and removing the middlemen.

4. Challenges Facing DeFi

Despite its transformative potential, DeFi faces several challenges that could hinder its widespread adoption:

4.1 Security Risks

Smart contracts, while powerful, are not immune to bugs and vulnerabilities. Hacks and exploits have occurred, leading to millions of dollars in losses. One of the most notable events was the Dao Hack in 2016, which exploited a vulnerability in the DAO (Decentralized Autonomous Organization) smart contract, leading to a hard fork of the Ethereum blockchain.

Although security audits and tests are improving, the risk of coding errors or malicious attacks remains a significant challenge.

4.2 Scalability Issues

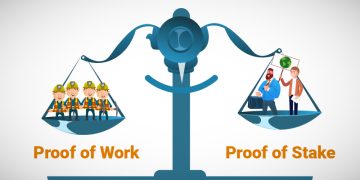

The Ethereum network, which powers most DeFi applications, has faced scalability issues. The current Ethereum blockchain can only handle around 30 transactions per second (TPS), a far cry from what is required for global financial systems. High congestion leads to high gas fees, making DeFi transactions expensive for small traders and investors.

4.3 Regulatory Uncertainty

The lack of clear regulatory frameworks around DeFi presents both opportunities and risks. Governments around the world are grappling with how to regulate DeFi platforms. While some countries are embracing DeFi, others are implementing or planning to impose stricter regulations on cryptocurrency and DeFi.

As DeFi continues to grow, regulators will likely introduce laws aimed at protecting investors and curbing illegal activities, such as money laundering and fraud.

5. The Future of DeFi

The future of DeFi appears bright, with continuous innovation and an expanding user base. However, the following trends and developments will be crucial for its success:

5.1 Layer 2 Solutions

Layer 2 scaling solutions, such as Optimistic Rollups and ZK-Rollups, aim to address Ethereum’s scalability issues by processing transactions off-chain and then settling them on the Ethereum blockchain. These solutions will help reduce transaction costs and improve throughput, making DeFi more accessible and efficient.

5.2 Cross-Chain Interoperability

As the DeFi ecosystem grows, interoperability between different blockchains will become increasingly important. Platforms like Polkadot and Cosmos are already working on cross-chain interoperability, enabling assets and data to move seamlessly between different blockchains. This will help users access DeFi services across various platforms and broaden the DeFi ecosystem.

5.3 Institutional Adoption

As DeFi matures, institutional investors are beginning to show interest in the sector. The introduction of DeFi ETFs, regulated DeFi platforms, and institutional-grade liquidity pools will likely lead to more institutional involvement, bringing legitimacy and more capital into the space.

6. Conclusion

DeFi is undoubtedly one of the most transformative forces in the cryptocurrency and financial worlds today. Its ability to democratize finance, reduce costs, and increase efficiency is reshaping the global financial landscape. However, challenges related to security, scalability, and regulation remain hurdles that need to be addressed for DeFi to reach its full potential.

The future of DeFi is bright, but its success will depend on continued innovation, regulatory clarity, and collaboration across the blockchain ecosystem. As more individuals, businesses, and institutions embrace decentralized finance, we are witnessing the beginning of a financial revolution that could ultimately change the way we interact with money, assets, and financial services forever.