Introduction

The global financial ecosystem is undergoing a transformative shift, driven by the rise of cryptocurrencies, blockchain technology, and decentralized finance (DeFi). Among the most significant developments in recent years are Central Bank Digital Currencies (CBDCs) and stablecoins—both of which are reshaping the dynamics of money, payments, and economic systems. While CBDCs are digital currencies issued and regulated by central banks, stablecoins are digital assets designed to maintain a stable value, often pegged to traditional assets like fiat currencies or commodities.

Though these two categories of digital assets have distinct functions, their relationship and the interplay between them are having profound implications for the global crypto market. This article explores the relationship between CBDCs and stablecoins, examining how their development and adoption influence the broader cryptocurrency ecosystem.

1. Central Bank Digital Currencies (CBDCs): An Overview

CBDCs are digital versions of a country’s fiat currency, issued and backed by the central bank. They aim to combine the benefits of digital payments with the security and stability of central bank money. Unlike cryptocurrencies such as Bitcoin or Ethereum, which operate on decentralized networks, CBDCs are centralized and controlled by government institutions.

1.1 Types of CBDCs

There are generally two types of CBDCs:

- Retail CBDCs: These are intended for the general public, allowing individuals and businesses to hold and transact using digital versions of a country’s currency.

- Wholesale CBDCs: These are primarily for financial institutions and enable faster, more efficient settlement of interbank transactions.

1.2 Key Features of CBDCs

- Centralized Control: CBDCs are governed by the central bank, which can regulate the supply and control inflation.

- Financial Inclusion: CBDCs can provide access to digital financial services for populations that are unbanked or underbanked.

- Reduced Transaction Costs: CBDCs could make payments more efficient by eliminating intermediaries and reducing transaction fees.

1.3 Advantages of CBDCs

- Security and Stability: As central bank-issued digital assets, CBDCs carry the credibility and trust of national governments, ensuring stability and security.

- Enhanced Payment Efficiency: CBDCs can streamline domestic and cross-border payment systems, making transactions faster and more cost-effective.

- Monetary Policy Control: Central banks can use CBDCs to enhance their ability to control the money supply, interest rates, and inflation.

1.4 The Global Adoption of CBDCs

Several countries have already launched or are in the process of piloting CBDCs. China, for example, has been at the forefront with its digital yuan, while countries like Sweden, the Bahamas, and the United Arab Emirates have also made strides toward implementing their own digital currencies.

2. Stablecoins: An Overview

Stablecoins are a category of digital currencies designed to maintain a stable value by being pegged to an underlying asset, typically a fiat currency such as the US Dollar, or a commodity like gold. Unlike cryptocurrencies like Bitcoin, whose value is highly volatile, stablecoins are designed to provide price stability, making them suitable for everyday transactions and as a store of value.

2.1 Types of Stablecoins

There are three primary types of stablecoins:

- Fiat-collateralized Stablecoins: These are backed 1:1 by a fiat currency (e.g., USD), with reserves held by a trusted custodian. Examples include Tether (USDT) and USD Coin (USDC).

- Crypto-collateralized Stablecoins: These stablecoins are backed by cryptocurrencies rather than fiat. They are often over-collateralized to account for volatility. An example is Dai (DAI), which is backed by Ethereum and other assets.

- Algorithmic Stablecoins: These stablecoins use algorithms and smart contracts to regulate their supply and demand, without being backed by collateral. Examples include Ampleforth (AMPL) and Terra (LUNA) (before its collapse).

2.2 Key Features of Stablecoins

- Price Stability: Stablecoins maintain a stable value, making them ideal for use in decentralized finance (DeFi) applications, remittances, and trading.

- Transparency and Trust: Most fiat-backed stablecoins provide transparency regarding their reserves, offering periodic audits to ensure that each token is fully backed by collateral.

- Global Reach: Stablecoins can be used across borders without the need for traditional banking infrastructure, enabling faster and cheaper international transactions.

2.3 Advantages of Stablecoins

- Stability in a Volatile Market: Stablecoins offer the benefits of digital assets, such as low-cost, fast transactions, without the volatility often seen in cryptocurrencies like Bitcoin or Ethereum.

- Ease of Use in DeFi: Stablecoins are widely used in decentralized applications (dApps) and DeFi protocols as collateral, lending, and borrowing assets, allowing for greater liquidity and ease of trading.

- Lower Transaction Costs: Stablecoins facilitate international payments and remittances with significantly lower fees compared to traditional banking methods.

2.4 Popular Stablecoin Projects

- Tether (USDT): The largest stablecoin by market capitalization, Tether is used widely in crypto exchanges for trading pairs and liquidity.

- USD Coin (USDC): A regulated stablecoin backed by fully audited reserves, USDC is widely adopted in DeFi platforms and blockchain ecosystems.

- Dai (DAI): A decentralized stablecoin collateralized by Ethereum, Dai is a critical component in the MakerDAO ecosystem.

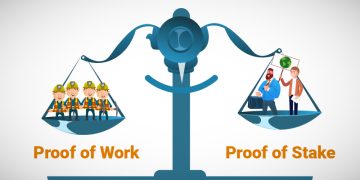

3. CBDCs vs. Stablecoins: Key Differences

While both CBDCs and stablecoins aim to provide price stability and improve the efficiency of digital payments, they differ in several key areas:

3.1 Issuance and Control

- CBDCs: Centralized and issued by central banks, CBDCs are government-backed and heavily regulated.

- Stablecoins: Issued by private entities, stablecoins are typically backed by assets held by the issuer, but their regulatory oversight varies depending on jurisdiction.

3.2 Stability and Trust

- CBDCs: Since CBDCs are backed by central banks, they are generally considered highly stable and trustworthy.

- Stablecoins: While stablecoins aim to maintain price stability, they can be subject to risks such as algorithmic failures or inadequate collateralization, particularly in the case of less transparent stablecoins.

3.3 Use Cases

- CBDCs: Primarily used for domestic payments and facilitating central bank monetary policy. Wholesale CBDCs focus on improving interbank settlement systems, while retail CBDCs enable everyday consumer transactions.

- Stablecoins: Used primarily in decentralized finance (DeFi), for cross-border payments, and as a stable store of value in the cryptocurrency ecosystem.

3.4 Privacy and Anonymity

- CBDCs: Privacy concerns have been raised with CBDCs, as they are centralized and controlled by governments. This can lead to concerns regarding surveillance and government control over personal financial transactions.

- Stablecoins: While some stablecoins, like privacy-focused coins (e.g., Monero), may offer privacy features, the transparency of stablecoin transactions on public blockchains can provide an added layer of security but also reduces anonymity.

4. The Impact of CBDCs and Stablecoins on the Crypto Market

The rise of CBDCs and stablecoins has profound implications for the crypto market, including its structure, liquidity, regulation, and market dynamics. The development of these digital assets could alter the relationship between traditional finance and decentralized finance (DeFi).

4.1 The Emergence of Digital Sovereign Currencies

The launch of CBDCs could pose both challenges and opportunities for cryptocurrencies like Bitcoin and Ethereum. On the one hand, CBDCs could lead to greater regulatory scrutiny and limit the use cases for decentralized digital assets. On the other hand, CBDCs could also foster a wider acceptance of digital currencies, making it easier for people to interact with blockchain-based ecosystems.

4.2 Stablecoins as the Bridge Between Fiat and Crypto

Stablecoins play a crucial role in bridging the gap between fiat currencies and the decentralized cryptocurrency market. By offering a stable digital asset, stablecoins help bring traditional investors into the crypto ecosystem, enabling seamless trading, collateralization, and DeFi participation. The coexistence of stablecoins with CBDCs could further integrate traditional finance and the crypto market, paving the way for more interoperable financial systems.

4.3 Regulatory Developments

As both CBDCs and stablecoins continue to gain traction, regulators around the world will likely introduce new frameworks to ensure the stability and security of digital currencies. CBDCs, being government-backed, are expected to be tightly regulated, while stablecoins could face regulatory challenges around transparency, reserve management, and anti-money laundering (AML) requirements.

4.4 CBDCs and DeFi Innovation

The integration of CBDCs into the decentralized finance space could lead to the creation of hybrid systems that combine the advantages of both centralized and decentralized financial models. For instance, CBDCs could be used for stable-value digital assets in DeFi protocols, offering governments greater control over monetary policy while enabling private market innovation.

4.5 Cross-Border Payments

CBDCs could significantly reduce the friction in cross-border payments, offering faster, cheaper, and more secure transactions compared to traditional methods. Stablecoins are already being used in international remittances, but CBDCs could challenge the dominance of stablecoins in this area, especially if governments issue CBDCs that are interoperable across borders.

5. Conclusion

The relationship between CBDCs and stablecoins is complex, with each influencing the trajectory of the crypto market in

unique ways. While CBDCs represent the evolution of government-backed digital currencies with centralized control, stablecoins offer a decentralized alternative that provides stability in the volatile world of cryptocurrencies. Together, these two innovations have the potential to reshape the future of money, payments, and finance.

As the crypto market continues to mature, it is likely that CBDCs and stablecoins will coexist, each serving distinct purposes but also complementing one another. Central banks will need to balance the benefits of CBDCs with the innovation and flexibility that stablecoins bring to the table. Meanwhile, the growing adoption of both CBDCs and stablecoins will play a pivotal role in fostering the development of a more efficient, inclusive, and secure global financial system.

By understanding the relationship between these two types of digital currencies, policymakers, financial institutions, and crypto market participants can better navigate the evolving landscape and ensure the responsible and sustainable growth of the digital economy.