Introduction

The rise of blockchain technology and the explosion of digital assets, including cryptocurrencies, non-fungible tokens (NFTs), and decentralized finance (DeFi) protocols, has transformed the global financial landscape. As these technologies gain mainstream adoption, they present both unprecedented opportunities and complex challenges, particularly in terms of taxation and regulatory oversight.

Unlike traditional financial assets, digital assets operate in a decentralized, borderless environment, making them difficult to categorize under existing tax frameworks. The anonymity of blockchain transactions and the lack of clear regulations in many jurisdictions further complicate the implementation of tax policies.

This article will explore the challenges and solutions to implementing reasonable tax measures for crypto assets, NFTs, and DeFi protocols in this rapidly evolving market. It will discuss the current global regulatory landscape, examine how different countries are approaching digital asset taxation, and propose potential frameworks for fair and effective tax management.

1. The Complexity of Taxing Digital Assets

1.1. Nature of Crypto Assets

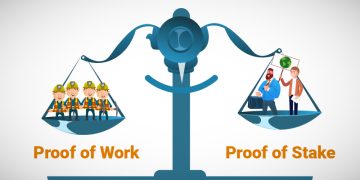

Crypto assets like Bitcoin, Ethereum, and altcoins have become a prominent asset class. Unlike traditional assets, these digital currencies are decentralized and traded on blockchain networks, which makes them challenging to categorize under existing tax laws. Some key features of crypto assets include:

- Decentralization: Crypto assets operate without the need for intermediaries like banks or governments. This peer-to-peer system eliminates the direct involvement of a central authority, making taxation difficult.

- Volatility: The extreme volatility in the price of cryptocurrencies complicates valuation for tax purposes. Tax authorities face challenges in determining the fair market value of assets that can fluctuate dramatically within short periods.

- Anonymity: Many cryptocurrencies, especially privacy coins like Monero and ZCash, offer a higher degree of privacy, making it harder for tax authorities to track transactions and identify taxable events.

1.2. NFTs and Their Unique Tax Implications

Non-fungible tokens (NFTs) have emerged as unique digital assets representing ownership of digital or physical assets. Each NFT is distinct, and its value is often driven by rarity, utility, and demand within the marketplace. Key challenges related to the taxation of NFTs include:

- Valuation: NFTs are highly subjective, and their prices are determined by the market, which can fluctuate wildly. For tax purposes, determining the accurate value at the time of a transaction is complicated.

- Ownership and Transfer: Unlike cryptocurrencies, NFTs are tied to specific digital or physical assets, such as art, music, and even virtual real estate. The sale, transfer, or creation of NFTs often involves capital gains taxation, but their unique nature creates ambiguity in the tax treatment.

- Royalty Models: NFTs often have built-in royalty mechanisms, which can generate ongoing revenue for creators. Taxing these royalty payments can be complicated, as they may differ from traditional income models.

1.3. DeFi Protocols and Tax Complexity

Decentralized finance (DeFi) refers to a set of protocols and platforms that facilitate financial services like lending, borrowing, trading, and staking, without relying on traditional financial institutions. DeFi applications have created new types of transactions, further complicating tax reporting. Challenges include:

- Transaction Types: DeFi platforms allow users to engage in lending, staking, yield farming, liquidity provision, and derivatives trading. Each of these activities may generate different tax obligations, such as interest income, capital gains, or fees.

- Cross-Border Issues: Since DeFi is borderless, users and protocols can operate across multiple jurisdictions, making tax enforcement difficult. The decentralization of DeFi protocols also means that there is no clear party to impose tax obligations upon.

- Smart Contracts and Automated Processes: DeFi platforms operate using smart contracts, which are self-executing programs that automatically enforce transaction terms. This automation raises questions about the responsibility for taxes on transactions conducted without human intervention.

2. Global Taxation Frameworks for Digital Assets

2.1. United States: Regulatory Clarity and Challenges

The United States has made strides in defining digital asset taxation, but challenges remain due to the rapid evolution of technology and the lack of clarity in some areas. Key developments include:

- IRS and Cryptocurrency Taxation: The Internal Revenue Service (IRS) treats cryptocurrencies as property rather than currency. As a result, crypto transactions are subject to capital gains tax, similar to stocks or bonds. The tax rate depends on the holding period—short-term capital gains are taxed at ordinary income rates, while long-term gains enjoy a reduced tax rate.

- NFTs and Taxation: NFTs are treated as property for tax purposes. When sold, they are subject to capital gains tax. However, the valuation and tracking of NFTs can be difficult, especially in the case of airdrops or minting (the creation of NFTs).

- DeFi Taxation: The IRS has yet to provide specific guidance on DeFi transactions. However, general principles suggest that interest or rewards earned from DeFi protocols (such as liquidity pools or staking rewards) may be subject to income tax. Furthermore, transactions like lending or staking could trigger capital gains tax when assets are sold.

2.2. European Union: Harmonization Efforts and Innovation

The European Union (EU) is working toward harmonizing tax policies for digital assets, though individual member states have differing approaches. Key initiatives include:

- VAT Exemption for Cryptocurrencies: The European Court of Justice ruled that cryptocurrency transactions should be exempt from Value Added Tax (VAT), which aligns with the EU’s stance of treating cryptocurrencies as financial instruments.

- Anti-Money Laundering (AML) and KYC Regulations: The EU’s Fifth Anti-Money Laundering Directive (5AMLD) has extended AML and KYC regulations to crypto exchanges and wallet providers. This will help improve transparency and make it easier for tax authorities to monitor transactions.

- Digital Assets Taxation: Individual EU countries have adopted different tax treatment models. For example, Germany treats cryptocurrencies as private assets, with capital gains tax applying only if the asset is sold within a year. Meanwhile, Portugal is more favorable, offering tax exemptions on crypto trading profits.

2.3. Asia: Varied Approaches and Emerging Markets

In Asia, tax policies for digital assets are evolving, with countries like China, Japan, and Singapore taking different approaches.

- China: China has been actively cracking down on cryptocurrency trading and mining, and it has imposed strict regulations on digital assets. While the country has not yet developed a comprehensive tax framework for cryptocurrencies, it’s unlikely that China will adopt an open regulatory stance in the near future.

- Japan: Japan treats cryptocurrencies as miscellaneous income, and capital gains tax is applied to crypto transactions. NFTs are also considered taxable under the same category. DeFi activities are taxed based on the nature of the income generated, and Japan is working to refine its taxation policy for digital assets.

- Singapore: Singapore has a favorable tax environment for digital assets. It does not impose a capital gains tax and offers tax exemptions for cryptocurrency transactions. However, digital assets that are treated as goods or services are subject to Goods and Services Tax (GST).

3. Taxation Solutions for Crypto Assets, NFTs, and DeFi

3.1. Establishing Clear Definitions and Guidelines

The first step in creating a workable taxation framework for digital assets is defining clear categories for crypto assets, NFTs, and DeFi activities. Tax authorities need to:

- Classify digital assets in a way that accounts for their unique characteristics. This would help provide clarity on whether they should be taxed as property, currency, or securities.

- Create specific guidelines for NFTs, including how to handle the sale, transfer, and creation of NFTs for tax purposes. This includes defining whether NFTs should be taxed as capital gains or royalty income when sold.

- Provide clarity for DeFi users, including determining how rewards, interest, and token exchanges are taxed. Tax authorities should create comprehensive guidelines for DeFi protocols to clarify tax obligations for individuals and businesses engaging in these platforms.

3.2. Implementing Effective Reporting Mechanisms

Given the decentralized nature of digital asset markets, implementing effective reporting mechanisms is crucial. Governments can require:

- Mandatory reporting by exchanges: Crypto exchanges should be obligated to provide detailed transaction records, including purchase prices, sale prices, and transaction fees to facilitate accurate tax reporting.

- Blockchain transaction tracking tools: To address the anonymity challenges of blockchain, governments can partner with firms that specialize in blockchain data analytics to track transactions and generate accurate tax reports.

3.3. International Cooperation and Tax Harmonization

As digital assets operate in a borderless environment, international cooperation will be crucial to implementing effective tax policies. Countries should:

- Collaborate on international tax standards: The Organisation for Economic Co-operation and Development (OECD) has already made significant progress in creating global guidelines for taxing digital assets, and countries should work together to harmonize their tax laws for digital assets.

- Address cross-border tax issues: DeFi platforms and crypto assets often cross national borders, making it difficult for any one country to enforce tax laws. Bilateral agreements and international

treaties can help address this issue.

Conclusion

The rapid development of crypto assets, NFTs, and DeFi protocols presents significant challenges for tax authorities worldwide. To create a fair and effective tax framework for these digital assets, governments must move beyond traditional tax models and establish clear definitions, reporting mechanisms, and international cooperation.

With evolving technologies and increasing global adoption, a reasonable and transparent approach to taxation can promote innovation, ensure fair competition, and protect taxpayers while fostering the growth of the digital asset ecosystem. The future of tax regulation will require a delicate balance between fostering innovation and ensuring compliance, enabling the digital asset market to thrive sustainably and equitably.