Introduction

The cryptocurrency market has seen exponential growth over the past decade, with Bitcoin, Ethereum, and other digital assets becoming central to decentralized finance (DeFi), digital identity, and various blockchain-based applications. As cryptocurrencies become more mainstream, however, they also attract cybercriminals seeking to exploit the vulnerabilities in blockchain technology, cryptocurrency exchanges, wallets, and decentralized finance (DeFi) platforms.

Although the blockchain itself is considered secure, it is the surrounding ecosystem, including exchanges, wallets, and applications, that are more vulnerable to cyberattacks. Therefore, understanding how cryptocurrency security works and how hacking incidents have shaped the industry is crucial for investors seeking to protect their assets. This article explores how cryptocurrency security can safeguard investments in the face of rising cyber threats and what strategies and measures can be employed to mitigate the risks.

I. The Rise of Cybersecurity Threats in the Cryptocurrency Ecosystem

Cryptocurrencies are built on decentralized networks, making them resistant to traditional forms of attack. However, their open-source nature, combined with the lack of centralized governance, makes them susceptible to a range of cyberattacks.

Key Security Risks:

- Centralized Platforms and Exchanges: While the blockchain is decentralized, most cryptocurrency exchanges and wallets are centralized and operate as custodians of funds, making them prime targets for hackers.

- Phishing and Social Engineering Attacks: Hackers often use phishing tactics to trick individuals into revealing their private keys or login credentials. These attacks exploit human error rather than technical vulnerabilities.

- Malicious Smart Contracts: Smart contracts, which execute predefined actions automatically, can have flaws that hackers exploit to drain funds from decentralized applications (dApps).

- Wallet Breaches: Digital wallets, whether online (hot wallets) or offline (cold wallets), are critical storage systems for cryptocurrencies. If hackers gain access to private keys or wallet backups, they can steal assets.

II. Notable Cryptocurrency Hacks and Their Impact on Investments

Several high-profile cyberattacks in the cryptocurrency space have underscored the importance of securing digital assets. These incidents have not only caused immense financial losses but have also shaped the way security measures are designed and implemented.

1. Mt. Gox Hack (2014)

- Overview: Mt. Gox, once the world’s largest Bitcoin exchange, was hacked in 2014, resulting in the loss of approximately 850,000 BTC (worth billions at the time).

- Impact on Investors: The hack led to the collapse of Mt. Gox and shook investor confidence in the cryptocurrency ecosystem. This event highlighted the risks of centralized exchanges and led to the development of more secure trading platforms and better regulatory frameworks.

2. The Poly Network Hack (2021)

- Overview: In 2021, hackers exploited a vulnerability in the Poly Network, a cross-chain protocol, to steal over $600 million in various cryptocurrencies.

- Impact on Investors: Although the majority of the funds were returned by the hacker, the attack illustrated the vulnerabilities inherent in decentralized finance platforms, especially those that bridge multiple blockchain networks.

3. Bitfinex Hack (2016)

- Overview: Bitfinex, a leading cryptocurrency exchange, was hacked in 2016, resulting in the loss of approximately 120,000 BTC, worth over $70 million at the time.

- Impact on Investors: The hack raised concerns about the security of exchange platforms and spurred the industry to adopt better security practices, including multisignature wallets and enhanced encryption protocols.

4. KuCoin Hack (2020)

- Overview: In 2020, hackers breached KuCoin, one of the top cryptocurrency exchanges, and stole over $280 million in assets.

- Impact on Investors: The incident led to a wider industry discussion on the need for improved security measures, such as insurance for customers and better cold storage solutions.

These hacks reveal the high stakes involved in cryptocurrency investments and the critical importance of both technical security measures and investor vigilance.

III. How Cryptocurrency Security Measures Protect Investments

As the cryptocurrency ecosystem matures, more robust security protocols are being developed to protect users’ investments from hacking and theft.

1. Multi-Signature Wallets (Multi-Sig)

Multi-signature wallets require multiple private keys to authorize a transaction. This additional layer of security helps reduce the risk of a single point of failure.

- Use Case: Exchanges and large institutional investors often use multi-sig wallets to secure their assets. Even if one private key is compromised, the attacker would still need additional keys to complete a transaction.

2. Cold Storage Solutions

Cold storage refers to keeping cryptocurrency keys offline, typically on hardware wallets or paper wallets. Cold wallets are immune to online hacking attempts, making them the most secure method of storing large quantities of digital assets.

- Use Case: Long-term holders (HODLers) and institutional investors often store the majority of their assets in cold storage to protect them from cyberattacks.

3. Smart Contract Audits

Smart contracts are self-executing contracts with the terms of the agreement written in code. While the code is transparent and immutable, vulnerabilities in the smart contract can be exploited by hackers.

- Use Case: Regular security audits by third-party firms can help identify potential flaws in smart contract code before deployment, preventing costly exploits.

4. Bug Bounty Programs

Many cryptocurrency projects offer bug bounty programs, where ethical hackers are rewarded for finding vulnerabilities in their platforms. These programs allow the crypto community to detect security issues before they can be exploited by malicious actors.

- Example: Ethereum, Polkadot, and many other DeFi projects run bug bounty programs to encourage responsible disclosure of vulnerabilities.

5. Two-Factor Authentication (2FA)

2FA requires users to provide two forms of identification (e.g., a password and a one-time code sent to a phone) before accessing their accounts. This extra layer of security is essential for protecting accounts from unauthorized access.

- Use Case: Nearly all reputable exchanges and wallets now require 2FA to prevent hackers from accessing accounts even if they have obtained a user’s password.

IV. The Role of Blockchain Security in Protecting Investments

While cryptocurrency exchanges and wallets face the most immediate threats, the underlying blockchain technology itself is generally considered secure due to its decentralized nature and cryptographic algorithms. However, security concerns persist in areas such as 51% attacks and vulnerabilities in the consensus mechanisms of certain blockchain protocols.

1. Decentralization and Immutability

Blockchain’s decentralized design ensures that there is no single point of failure, and the immutability of blockchain transactions means that once data is recorded, it cannot be altered or deleted without consensus from the network. This makes blockchain-resistant to many common attack methods, such as data manipulation.

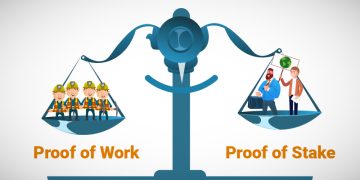

2. Proof-of-Work (PoW) and Proof-of-Stake (PoS) Security

- PoW: In a proof-of-work system, such as Bitcoin, security is ensured by miners who solve complex mathematical puzzles to validate transactions and add blocks to the blockchain. The computational power required to attack the network makes such attacks highly impractical.

- PoS: In proof-of-stake systems, validators are chosen based on the amount of cryptocurrency they hold and are incentivized to act honestly. Security is maintained by penalties for dishonest behavior and rewards for legitimate activity.

3. Quantum-Resistant Cryptography

As quantum computing advances, traditional cryptographic algorithms may become vulnerable to attack. To counter this, developers are working on quantum-resistant cryptographic algorithms that will ensure blockchain security in the age of quantum computing.

- Future Outlook: The rise of quantum computing will likely prompt a shift toward more secure, quantum-proof protocols to protect against potential future threats.

V. Regulatory Oversight and Legal Protections

Governments and regulatory bodies around the world are beginning to implement frameworks to protect cryptocurrency users and investors, making the ecosystem safer.

1. Regulatory Measures

Countries like the U.S. and the European Union have introduced laws and regulations aimed at improving the security of cryptocurrency platforms.

- U.S. Regulations: The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) oversee cryptocurrency-related securities, preventing fraud and market manipulation.

- MiCA Regulation in the EU: The EU’s Markets in Crypto-Assets (MiCA) framework is designed to provide a regulatory approach for crypto assets, ensuring transparency and protecting consumers.

2. Consumer Protection Standards

Regulatory bodies are working to enforce consumer protection standards, including mandates for exchanges to hold a reserve of funds to cover potential losses and to comply with Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

VI. Best Practices for Cryptocurrency Investors

Despite the technological advancements in security, investors must adopt best practices to protect their own assets:

- Diversify Holdings: Don’t store all your assets on one exchange or in one wallet. Distribute them across different platforms to reduce risk.

- Use Trusted Platforms: Stick to well-known and reputable exchanges and wallets that prioritize security.

- Regularly Update Security Protocols: Update passwords, use hardware wallets, and enable 2FA wherever possible.

- Educate Yourself on Scams: Be aware of common scams and phishing attacks. Always double-check the URLs and the authenticity of communications from cryptocurrency platforms.

Conclusion

As the cryptocurrency industry continues to evolve, the importance of securing digital assets cannot be overstated. Although cyberattacks remain a significant threat, the development of advanced security features like multi-signature wallets, cold storage, and smart contract audits will continue to enhance the protection of investor assets. Moreover, with increasing regulatory oversight, the cryptocurrency ecosystem is gradually becoming safer for investors. By adopting proper security

measures and staying informed about the latest developments, investors can minimize the risks posed by hackers and safeguard their digital investments.

Let me know if you’d like further details on any section!